China's appetite for fuel oil has diminished sharply.

The country's decision to allow independent (also referred to as 'teapot') refineries ample access to crude supply was a major reason for the 17% drop in fuel oil imports to 0.24mb/d in 2014.

Standard Chartered notes...

- We expect apparent demand to decline by 9% in 2015, and by approximately 5% or 0.55mb/d in 2016.

- The industry's move to increased complexity and hence lower yields for residual fuel oil will likely offset some of the decline in demand.

- However, refinery-capacity expansion in China and the Middle East should substantially increase fuel oil supply and exacerbate already soft market conditions.

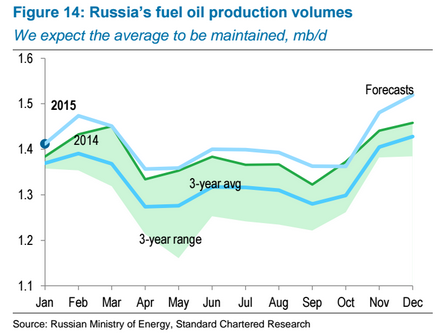

- Data from Russia's Ministry of Energy shows that fuel oil output increased by 4% in 2014.

- Despite the growth rate easing to 2% in January 2015, it should maintain its annual average of 1.4mb/d.

- The data points to increased crude processing volumes (up 6% in 2014 to an average of 5.8mb/d).

- We believe that most of this output was exported, putting further downward pressure on prices in the West.

- In short, our outlook for global residual fuel oil remains bearish in light of sufficient current supply, increasing production volumes in the near term as refinery capacity continues to expand, and reduced consumption in the expanded ECAs.

- We expect increased shipping activity, buoyed by lower fuel oil costs, but believe it will be insufficient to absorb impending higher supply.

- We expect substantial price support in early 2016 once increased production from new refineries in China, India and the Middle East has equilibrated.

- This, coupled with a more robust global economy, should lead to price stabilisation.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed