On the eve of Bank of England’s monetary policy today, let’s begin by recalling as to how the UK central bank confused the markets in previous MPS. There was the widespread surprise when the MPC chose to leave rates unchanged in the last monetary policy meeting.

For now, there is no reason in pretending otherwise: the Brexit vote would be a hard blow for the UK economy in the months to come. Although the economy developed in Q2, the collapse in Q3 and forward guidance has been very painful.

The PMI in the UK has provided a first taster. Manufacturing sector eased significantly from 55.5 points in the previous month to the current 54.3 points; the final estimate now resulted in a real collapse (consensus 54.6). The PMI for the construction sector managed to produce upbeat flashes at 52.6 versus consensus at 51.9 and previous prints at 52.3, where service PMIs would be announced today but had collapsed from 52.9 to 52.6 in October and points in the same direction.

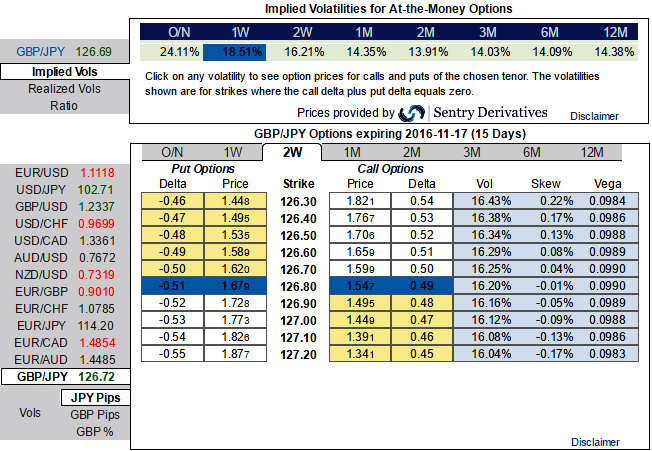

Please be noted that GBPJPY skew is not ready to smoothen too much ahead of central banks inflation report and monetary policy, the GBP volatility in 1-3m tenors normalized considerably.

The liquidity recovered and the extreme positioning was ultimately absorbed. The price action is not taking the direction of an imminent new trend. As a result, the option market aggressively unwound smile positions.

In our recent hedging portfolios we had advocated ITM put shorts when underlying FX price was at 127.35 levels, now you could probably guess that from the spot FX of GBPJPY, the yields from these shorts are certain by now.

Negatively skewed GBPJPY 1w IVs for now signify the interests of ATM put holders and their competitive edge in PRBS as an optimal hedge, consequently, we uphold -0.49 delta ATM puts.

Please be noted that the 1m GBPJPY IV skews are more biased towards OTM put strikes.

From the IV nutshell, one can understand that the negatively skewed IVs in 1m contracts would imply that the underlying spot FX is less likely to remain in ITM territory or in other words spot FX would shift towards OTM strikes.

There was also a valuation issue at play, in that yen, vols had lagged the sharp collapse in VXY prior to BoJ –held up in all likelihood by the outside chance of a policy regime shift in Japan –and were ripe for a sell-off if the meeting proved uneventful.

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data