Fundamentals to watch out for this week

Sep 11, 2017 10:05 am UTC| Commentary Central Banks

This week is a quite heavy with volatility risks, especially in terms of data and events as well. What to watch for over the coming days: Central banks: Swiss National Bank (SNB) will announce interest rate...

FxWirePro: Yuan weakens as PBoC relaxes shorting restrictions

Sep 11, 2017 07:13 am UTC| Commentary Central Banks

Yuan has declined sharply after reaching as low as 6.44 per dollar last week, the highest level since March 2016 and trading at 6.527 per dollar today as China relaxes shorting rule, that was imposed in response to yuans...

FxWirePro: A week before BoE and SNB - A glimpse through Sterling and Swiss franc

Sep 08, 2017 16:45 pm UTC| Central Banks Research & Analysis Insights & Views

Bank of England (BoE): The MPC convenes next week with its full complement of nine members for the first time since March. With no significant changes to the economic picture compared to last month, it is unlikely that...

Sep 08, 2017 13:02 pm UTC| Research & Analysis Insights & Views Central Banks

Short in USDTHB via 3m NDF are rolled out on account of structural current account improvement, neutral valuations. THB continues to remain top performer within EM Asia, strengthening by 8% this year and outperformance...

Fed Hike aftermath Series: Market pushed back rate hike expectation beyond June next year

Sep 08, 2017 12:49 pm UTC| Commentary Central Banks

This week, several key policymakers including Lael Brainard, Neel Kashkari, Robert Kaplan have warned against future rate hikes citing of lower inflation. Kashkari even went further to add that Fed rate hikes so far may...

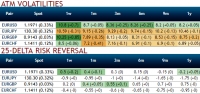

FxWirePro: Euro OTC FX to indicate dollar softness and ECB buoyancy

Sep 08, 2017 12:28 pm UTC| Research & Analysis Central Banks Insights & Views

The markets had been waiting for the ECBs monetary policy meeting and above all the subsequent press conference for days. What would ECB President Mario Draghi have to say on the strength of the euro? Only verbal...

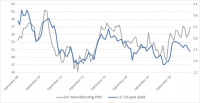

Worrisome Signs Series: Manufacturing PMI vs. U.S. 10-year yields

Sep 08, 2017 11:29 am UTC| Commentary Economy Central Banks

The above four charts show the relation between U.S. 10-year yields and manufacturing PMI numbers from the United States, Switzerland, Eurozone, and United Kingdom. We have chosen U.S treasury as a representative of global...

- Market Data