The markets had been waiting for the ECB’s monetary policy meeting and above all the subsequent press conference for days. What would ECB President Mario Draghi have to say on the strength of the euro? Only verbal interventions would be able to prevent appreciation, everyone agreed on that.

Today EURUSD is trading at 1.2070 and therefore over a cent higher than before the meeting. If anyone thinks Mr.Draghi and his ECB colleagues had not spoken about the subject they are mistaken. In the statement, a strong euro was given as the reason for changes to the ECB’s inflation projections (a tenth lower both in 2018 and in 2019).

Later on, during the Q&A session, Draghi even confirmed that the concerns about the strong euro that had only affected some members at the last meeting were now being shared by all participants. Those were clear words, but they were nonetheless not sufficient to stop the euro from taking off again. Now there will be voices pointing out that Draghi should have been more outspoken as references to a strong euro had been expected in the run-up to the meeting.

In my view, the euro strength is due to the fact that the ECB signaled that this wasn’t so problematical. The entire event was characterized by an obvious sense of optimism on the part of the ECB regarding the future development of inflation. Draghi explained over and over again that the ECB will reach its inflation target of just below 2%. Two reasons were mainly stated: 1.

Its own expansionary monetary policy (of course Draghi had to mention that) and 2. the economic strength in the euro zone. He referred explicitly to 6m new jobs. According to the ECB that will lead to higher wages and thus higher inflation.

In long term perspectives, we believe EURUSD’s 1.0350 was a major low, which completed the cycle from the 1.60 2008 highs. As such, we look for an eventual move back to the main medium-term resistance region between 1.2000 and 1.2350, while long-term targets lie in the 1.30-1.35 zone.

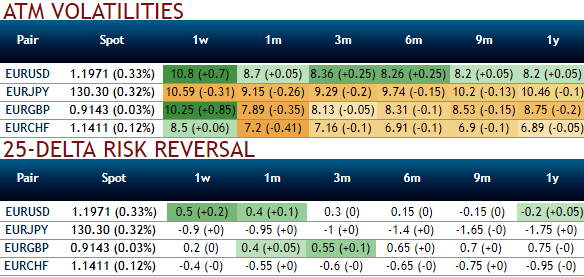

Contemplating all these factors, OTC markets have factored-in, please be noted that the implied vols, as well as risk reversals of euro crosses, have been considerably spiking higher on ECB’s monetary policy decision. Positive RRs in 1-3m tenors and positively skewed IVs would imply the euro’s strength. Vol pts Positive smile theta participation in Euro bull-trend.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices