Sep 29, 2017 07:27 am UTC| Research & Analysis Central Banks Insights & Views

For now, we all know that the dollar getting some traction, in response to Janet Yellens hawkish rhetoric while delivering speech at the NABE annual conference. Its was up by no more than 0.5% against any currency. The Fed...

RBI likely to keep policy unchanged as inflation looms, says Goldman Sachs Research

Sep 29, 2017 06:52 am UTC| Commentary Central Banks Economy

The Reserve Bank of India is scheduled to conclude its two-day monetary policy meeting on October 4 at 09:00 GMT. We expect the central bank will maintain status quo on policy rates as inflation seen rising towards the RBI...

Sep 28, 2017 12:35 pm UTC| Research & Analysis Insights & Views Central Banks

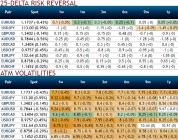

Before we proceed through the core part of this write up, lets have a glance through the implied volatilities of EURCHF ATM contracts from the above nutshell, IVs of this underlying pair of all expiries have still been the...

FxWirePro: Global central banks’ policy shift and frontiers on VXY valuations

Sep 28, 2017 10:57 am UTC| Central Banks Research & Analysis Insights & Views

The Fed was far from the only monetary policy game in town this week, and FX markets were as much driven by an ongoing repricing of BoE, policy rhetoric surprises in NOK, JPY, and to a lesser extent AUD. Rather than a...

Sep 28, 2017 07:20 am UTC| Central Banks Research & Analysis Insights & Views

RBA is scheduled to announce its cash rates on October 2nd followed by monetary policy statement. If the Aussie central bank remains firmly on hold, as we expect, AUD may lose its bullish streaks. While Mr Kuroda...

FxWirePro: Glimpse on G3 central banks and Macro trade perspectives in Q3’2017

Sep 28, 2017 06:21 am UTC| Central Banks Research & Analysis Insights & Views

The FOMC lent its imprimatur to the global reflation trade. For good measure, the Norges Bank also brought forward its lift-off by six months to mid-2019. The Feds confidence in US inflation and the repricing of a...

FxWirePro: Glimpse on G3 central banks and Macro trade perspectives in Q3’2017

Sep 28, 2017 06:21 am UTC| Central Banks Research & Analysis Insights & Views

The FOMC lent its imprimatur to the global reflation trade. For good measure, the Norges Bank also brought forward its lift-off by six months to mid-2019. The Feds confidence in US inflation and the repricing of a...

- Market Data