FxWirePro: 20th February Key updates

Feb 20, 2019 14:55 pm UTC| Commentary Central Banks

Here are some key updates that as a trader you need to keep a tab on. Brexit and UK politics: UKs Prime Minister Theresa May said that her government is seeking legally binding changes to Irish backstop that would...

FxWirePro: Derivatives Trades for High-Carry Currency Among G10 FX Universe

Feb 20, 2019 08:36 am UTC| Research & Analysis Central Banks

The dollar is a high-carry currency... Among the currencies of the industrialized countries (G10 FX), the US dollar is the one with the highest interest rate. And its going to stay that way for now. Isnt that in itself a...

FxWirePro: The Day Ahead- 20th February 2019

Feb 20, 2019 05:01 am UTC| Commentary Central Banks

Not many economic data and events scheduled for today, and all with low to medium volatility risks associated. Data released so far: Australia: Wage price index grew 0.5 percent q/q in Q4, up 2.3 percent from a...

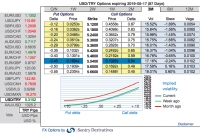

FxWirePro: CBT Drives USD/TRY Uptrend Resumption – Uphold Debit Call Spreads bidding 3m skews

Feb 19, 2019 14:08 pm UTC| Research & Analysis Central Banks Insights & Views

Last weekend, the Turkish central bank (CBT) cut reserve requirements on lira deposits by 100bps for short-term deposits (up to one year) and by 50bps for the longer duration. CBT also increased the share of the reserve...

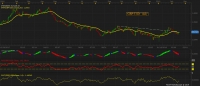

FxWirePro: Retail sentiment points to gradual downside in pound

Feb 19, 2019 09:05 am UTC| Commentary Central Banks

The British sterling is likely to face further slide, At least retail sentiment is pointing in that direction. The pound has already declined around 300 pips since it tested key resistance around 1.32 area....

FxWirePro: Retail sentiment points to further decline in euro

Feb 19, 2019 08:34 am UTC| Commentary Central Banks

Despite the recent bounce back, the single currency is likely to face further slide, At least retail sentiment is pointing in that direction. The euro has already declined around 200 pips since it tested key...

FxWirePro: The Day Ahead- 19th February 2019

Feb 19, 2019 04:18 am UTC| Commentary Central Banks

Lots of economic data and events scheduled for today, and all with low to medium volatility risks associated. Upcoming: Switzerland: December trade balance report will be released at 7:00 GMT. Italy:...

- Market Data