The dollar is a high-carry currency... Among the currencies of the industrialized countries (G10 FX), the US dollar is the one with the highest interest rate. And it's going to stay that way for now. Isn't that in itself a strong argument for a strong dollar?

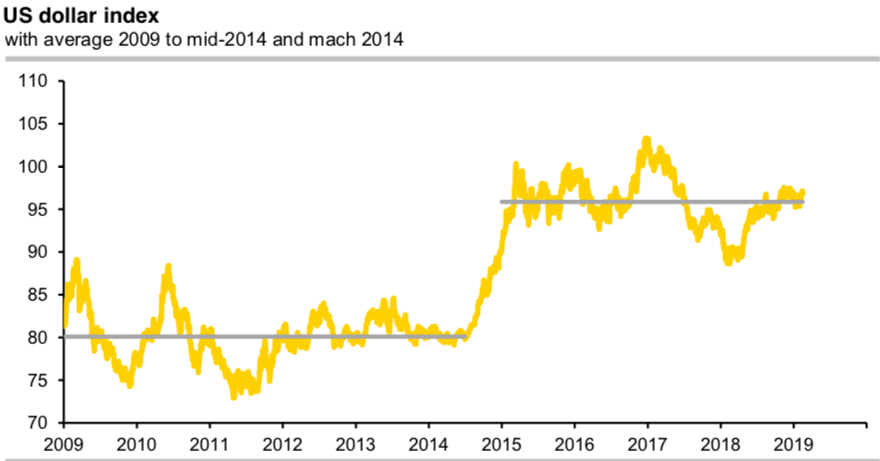

As a matter of fact, it is. However, this fundamental advantage of the dollar has long been priced into its exchange rates. In the course of 2014, it became foreseeable that the Fed would raise US interest rates in the not too distant future, while other central banks (e.g. the ECB and the Bank of Japan) would continue to remain ultra- expansionary for a long time – in some cases more and more. This is why the US currency appreciated at that time. Previously (2009 to mid-2014), the dollar index traded around 80, since the beginning of 2015 it is moving in the area near 95 (refer above chart).

Buy 2m 1.1320 EURUSD put; sell 1.16 EURUSD call for net cost of 11bp. Spot ref: 1.14 levels, while simultaneously maintain shorts in EURCHF at 1.1244 with a stop at 1.1469.

Alternatively, we advocate initiating longs in EURUSD futures contracts of Feb’19 delivery as further upside risks are foreseen in near terms. Simultaneously, shorts in futures of April’19 delivery. Thereby, one can directionally position their FX exposures. The directional implementation of the same trading theme by further allow for a correlation-induced discount in the options trading also if you choose strikes appropriately. Courtesy: Commerzbank

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 70 levels (which is bullish), while hourly USD spot index was at -90 (bearish) while articulating (at 08:34 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise