Last weekend, the Turkish central bank (CBT) cut reserve requirements on lira deposits by 100bps for short-term deposits (up to one year) and by 50bps for the longer duration. CBT also increased the share of the reserve requirements that can be held in gold to 10% from 5%. These steps have the effect of boosting domestic currency liquidity by c.TRY 3.3bn, and also boosting FX reserves of the central bank slightly.

USDTRY rose marginally following the announcement but reversed this move within the day. These moves are driven by broader risk sentiment and do not necessarily reflect the impact of the policy announcement. The direct effect of the policy change is, of course, marginal.

Nevertheless, it could have broader significance in signaling that CBT is facing pressure to find ways to indirectly ease monetary conditions and support bank lending and growth. Especially given the elections coming up in March, we are alert to signs of political pressure for extra stimulus.

In our view, headline inflation is likely to fall below 14% by Q3 – mainly because of base effects and even though CBT governor Murat Cetinkaya is asking us not to read anything into this RRR cut pressure is likely to mount for the CB to loosen monetary policy further using indirect measures. This is likely to exert depreciation pressure on the currency, medium-term. We see USDTRY heading up to 5.75 levels by Q1 next year.

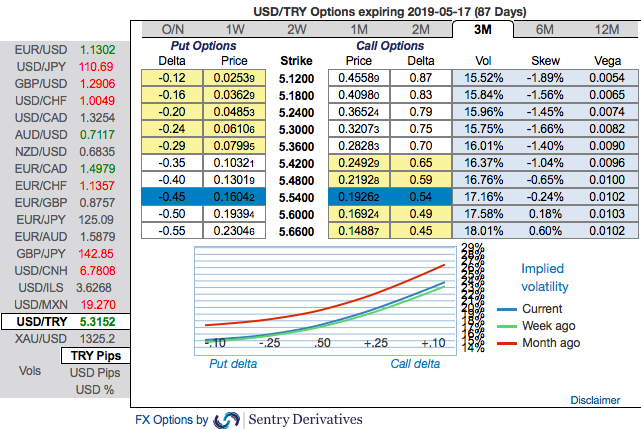

Trade tips: We advocated 3m USDTRY debit call spreads a week ago (3m 5.15/6.77 call spreads at net debit) at spot reference: 5.3035 levels, with a view to arresting upside risks when Turkish Finance Minister Berat Albayrak announced a cheap lending scheme for SME's. The underlying spot has slid a bit but well above ITM strikes, which means our short legs are performing desirably.

We now like to uphold the same strategy, thereby, one achieves hedging objective as the deep in the money call option with a very strong delta will move in tandem with the underlying spikes.

The rationale for the trading: Please be noted that 3m USDTRY IV skews are indicating the further upside risks.

It seems that hedgers of TRY are also in line with the above fundamental factors. As you could observe the above nutshell, IV skews indicate that the hedgers’ interests for OTM call remain intact.

IVs of this underlying pair is on the higher side, trending highest among the G20 FX space. Call options with a higher IVs cost more, because, increasing IV is desirable for the holder of the option, just for the intuition that the higher likelihood of the market ‘swinging’ in holder’s favor. Please also be noted short-dated options are less sensitive to IV, while long-dated is more sensitive. Courtesy: Commerzbank and Sentrix

Currency Strength Index: FxWirePro's hourly USD spot index was at -38 (bearish) while articulating (at 14:00 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts