Better Tankan survey means BOJ to stay put

Dec 14, 2015 06:41 am UTC| Commentary Central Banks

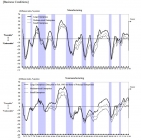

Today released, Tankan survey is likely to provide more ammunitions to Bank of Japan (BOJ) hawks (less dove actually) to argue for staying put and not increase stimulus from Current level. After European Central Banks...

Mexico GDP likely to post 2.5pct growth in 2015

Dec 14, 2015 06:25 am UTC| Commentary

Industrial production in Mexico posted a negative growth of 0.1% month on month sa in October. In annual term, the output increased by 1.2% year on year. The negative growth in monthly industrial output of the economy...

EUR/USD likely to be at 0.95 by end-2016

Dec 14, 2015 05:54 am UTC| Commentary

European Central banks rhetoric might at the December meeting might come at a long-term cost to EUR , while EUR/USD was forecasted higher last week. We continue to forecast EUR/USD at 0.95 by end-2016, says Barclays in...

Stronger USD likely to weigh on US core prices next year

Dec 14, 2015 05:49 am UTC| Commentary

Producer prices in the United States increased in November. Headline and core producer price index both are increased by 0.3% month on month in November. Transport and warehousing also posted same growth rate of...

Daily Economic Outlook: 14th December, 2015

Dec 14, 2015 05:46 am UTC| Commentary

Euro area industrial production and speeches from ECB President Draghi and the Bank of Englands Shafik are expected to draw markets attention today. CPI inflation In the U.K. due on Tuesday and labour market data on...

Guide to today’s important data and events

Dec 14, 2015 05:42 am UTC| Commentary

Few economic dockets scheduled for today, all with low risks associated. Data released so far - UK - Rightmove house price index dropped -1.1% in December, still up 7.4% from a year ago. Japan - Industrial...

US Fed unlikely to signal about future path post first hike, data-dependent approach to dominate

Dec 14, 2015 05:40 am UTC| Commentary Central Banks

US Federal Reserve is likely to begin its hiking cycle this year, in its December meeting, by rising its near-zero interest rates, as widely anticipated. The likely path of the cycle(not the already priced in first hike)...

- Market Data