Policy divergence between Fed and RBNZ likely to push NZD/USD towards 0.63

Dec 14, 2015 07:34 am UTC| Commentary Central Banks

In New Zealand, the key data releases are Q3 balance of payments and Q3 GDP. The latter is likely to rise, a payback for a soft H1. Business Confidence index and GT Dairy Auction are also due to release this week, the...

USD/CNY to trade at 6.60 by end-2016 despite further de-peg

Dec 14, 2015 07:25 am UTC| Commentary

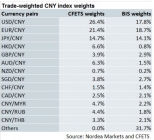

The central bank of China announced a new currency index last Friday, referred to CFETS RMB Index. The CFETS RMB Index is mainly a trade-weighted exchange rate of the CNY, which is measured against a basket of 13...

US October business inventories leave Q4 GDP tracking unchanged at 1.9%

Dec 14, 2015 07:17 am UTC| Commentary

US Business Inventories were steady in October(mom) at 0.1%, slightly below what market has anticipated. The retail inventories excluding motor vehicles, climbed 0.4% mom, which is the only new section of data with...

RBA likely concerned by relative currency strength

Dec 14, 2015 07:06 am UTC| Commentary Central Banks

Reserve Bank of Australia board meeting minutes likely to show that the board is encouraged by stronger activity signs and more signals that the housing market is being cooled by the recent round of macro-prudential...

Norges bank likely stand pat at December meeting despite oil price drop

Dec 14, 2015 06:55 am UTC| Commentary Central Banks

Norways inflation surprised the markets to the upside recently, and despite the long held hypothesis that the central bank is willing to bear a slight inflation shoot-up, it will not desire to fuel the weaker currency and...

China's economy shows sign of recovery

Dec 14, 2015 06:49 am UTC| Commentary

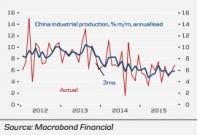

Industrial production in China inched up to 6.2% y/y in November in compare to 5.6% y/y in October, similarly, the monthly figure also increased from 0.5% to 0.6%. In addition to the industrial output some other key...

Riksbank likely to stand pat in December meeting

Dec 14, 2015 06:46 am UTC| Commentary Central Banks

Swedens Riksbank is expected widely to keep its policy rate on hold in its upcoming policy meeting tomorrow, but retain an easing bias. Disappointing ECB meeting and higher-lower-bound prospects in EA rates, have abated...

- Market Data