Today released, Tankan survey is likely to provide more ammunitions to Bank of Japan (BOJ) hawks (less dove actually) to argue for staying put and not increase stimulus from Current level.

After European Central Bank's (ECB) lower than expected stimulus, it more difficult for BOJ to increase their pace of purchase significantly. Central bankers are becoming more cautious on inflation across globe. Moreover at current pace of purchase, BOJ would gobble up entire JGB market by end of decade.

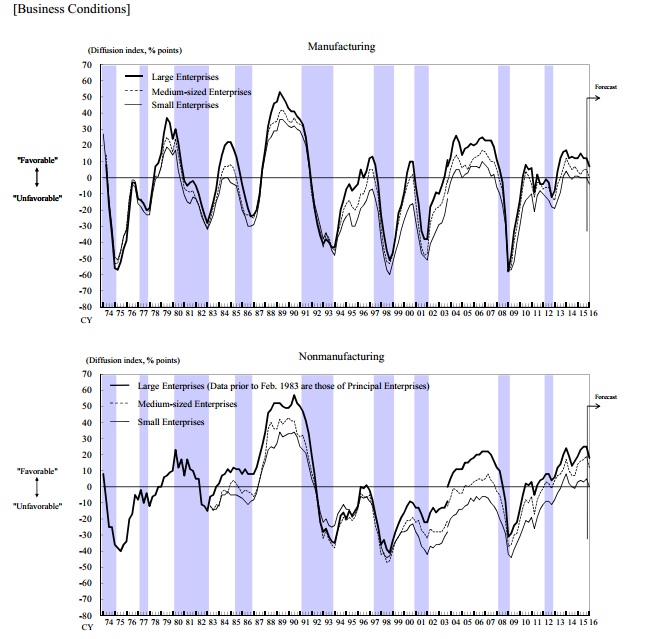

While BOJ members, continuously expressed worries over slowdown in China and turmoil in financial markets and sharp appreciation of Yen in response to August turmoil, Tankan survey showed that Japanese enterprises and manufacturing sector have weathered the storm well.

Tankan survey is of high importance for anyone, analyzing Japan and its economy. It survey's 10,000 companies and it is similar as ISM in US but released quarterly. Moreover, Tankan survey is BOJ policymakers' one of the favorites.

- Overall business sentiment came much stronger than anticipated. Business conditions for large manufacturers came at +12, about same level as September, defying market expectations of a drop.

- Reading for services came at +25, same as September and its hovering around highest of levels, since 1990.

- Companies raised their profit forecast by 2% from last report to 5.4% and increased their capex intentions from 6.5% to 7.8%.

- However, expectations forward is of slowdown, which is not unusual given the high reading.

For more, check out the original report at http://www.boj.or.jp/en/statistics/tk/gaiyo/2011/tka1512.pdf

Yen, however, weaker today with pause in risk-aversion, currently trading at 121.2 per Dollar.

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal