Is the dollar priced for Fed hikes?

Sep 09, 2015 00:28 am UTC| Commentary Central Banks

The US dollar (USD) has strengthened over 15% on a trade-weighted basis since endJune 2014. But, a decomposition of USD moves into days dominated by a Fed shock and those by a growth shock suggests otherwise. Instead, most...

Fed's rate hike and its implications

Sep 09, 2015 00:23 am UTC| Commentary Central Banks

With a final solid payroll number under the belt, focus now turns squarely to the FedsSeptember 17thrate hike decision. BofAML describes the economic and policy backdrop and then looks at likely market responses to...

Sep 08, 2015 23:46 pm UTC| Commentary Central Banks

The consensus among economists and the market is for a 25bp cut, but there is a range of opinions regarding the extent and timing of additional easing. Westpac explores three possible scenarios and predict the market...

Sep 08, 2015 22:20 pm UTC| Commentary Central Banks

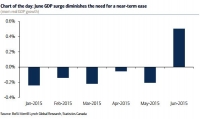

In the past few months, global economic uncertainty has put downward pressure on the price of Canadas resources, weighing on the nations already beleaguered resource patch. The price of WTI oil is $45/bbl (as this goes to...

CBR favouring RUB’s moderate weakening

Sep 08, 2015 04:09 am UTC| Commentary Central Banks

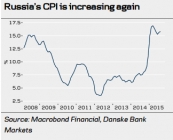

At the previous meeting on 31 July, the CBR reiterated its CPI forecast for June 2016, stating that annual inflation will fall under 7% reaching the 4% target in 2017. Upcoming price increases in Russia are expected to...

CBR likely to keep key rate unchanged in 11 September meeting

Sep 08, 2015 04:06 am UTC| Commentary Central Banks

Russias central bank (the CBR) will announce its monetary policy decision this week. The key rate is likely to remain unchanged at 11% p.a. in line with consensus, as RUB volatility has increased (although bearably) on...

Taiwan CBC likely to stay on hold in September

Sep 08, 2015 03:59 am UTC| Commentary Central Banks

Taiwan inflation is expected to recover gradually in H2, helped by a low base in Q4. Food prices are also likely to trend higher due to the typhoon season. Soft CPI should not be a concern to CBC, given it is mainly...

- Market Data