In the past few months, global economic uncertainty has put downward pressure on the price of Canada's resources, weighing on the nation's already beleaguered resource patch.

The price of WTI oil is $45/bbl (as this goes to print), roughly $15/bbl below the July MPR assumption. Thus, the Bank of Canada's (BoC) hopes for in-quarter growth of around 2.8% annualized in 2016 may be difficult to achieve, leaving a wide and persistent negative output gap.

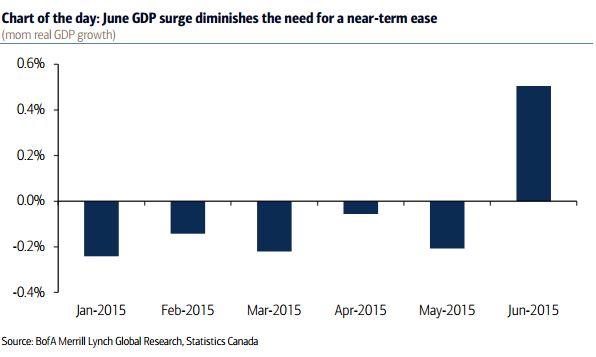

A few weeks ago, a September ease looked somewhat likely. However, oil prices have crept higher, and global headline growth risk has faded. Most importantly, recent news from Canadian economy has been encouraging, with GDP growth in Q2 of -0.5%, in line with the BoC's expectations. June GDP rose by a whopping 0.5% m/m, pointing to a solid end to a very weak first half of the year (Chart of the day). Thus, even, with underlying economic weakness likely on the horizon, there is little reason for the BoC to jump the gun and ease the overnight rate in September.

The BoC will likely nudge the overnight rate down in October if oil prices remain subdued and growth remains tepid, as further stimulus would be needed eliminate economic slack. Although the BoC will likely cite signs that growth is progressing in line with their expectations, global growth uncertainty and downward commodity price pressure should be cited as potential risks. As a mild offset, the CAD depreciation, which in part may have supported by a healthy increase in non-energy export volumes should be cited as a benefit. But the tone on these two offsetting forces should be neutral as it's still too early to tell the ultimate fallout.

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says