FxWirePro: The Day Ahead- 21st March 2019

Mar 21, 2019 03:53 am UTC| Commentary Central Banks

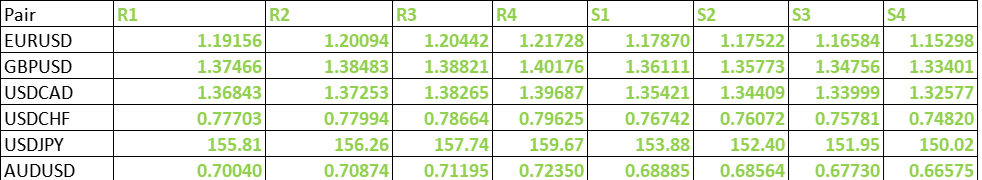

Lots of economic data and events scheduled for today, and some with high volatility risks associated. Data released so far: Australia: Unemployment rate declined to 8-year low to 4.9 percent, largely due to a drop...

Mar 20, 2019 13:54 pm UTC| Research & Analysis Central Banks

The US Fed meeting tonight is the todays key focus and the broad USD is holding support levels as are US yields as we head into the event even though the interest rates would likely be left unchanged for the second...

FxWirePro: What to watch in FOMC meet ahead?

Mar 20, 2019 13:13 pm UTC| Commentary Central Banks

The U.S. Federal Reserve is in a neutral mode, as Fed chair Powell has recently signaled the possibility of longer rate pause going ahead. Since December 2015, the U.S. Federal Reserve has hiked rates eight times. It has...

FxWirePro: Indian rupee gains both on technical and fundamental grounds – Stay short USD/INR

Mar 20, 2019 13:10 pm UTC| Research & Analysis Central Banks

USDINR has again slid below 68.75 marks withintraday bias remains bearish for the moment.We prefer to take a short position on both technical and fundamental grounds. Technically, the pair has formed the bearish...

Bank of Thailand keeps key policy rate on hold

Mar 20, 2019 12:43 pm UTC| Commentary Central Banks

The Bank of Thailand kept its key policy rate on hold at 1.75 percent today, as was anticipated. The decision to stand pat was unanimous, with all seven monetary policy committee members voting for a hold, compared to two...

Mar 20, 2019 11:58 am UTC| Research & Analysis Central Banks

All eyes are curiously focused on the two events, FOMC monetary policy meeting which concludes later today with investors assigning no hike in this monetary policy, likely to remain on hold at 2.50%. However, rising signs...

FxWirePro: Mild shift in Aussie FX options markets’ sentiments – Unwise to jack-up call options

Mar 20, 2019 08:29 am UTC| Research & Analysis Central Banks

AUDUSD bears resume their business after brief rallies, broader downside risk outlook remains intact, one could foresee the next target up to 0.70 or even below those levels in near term. While the medium-term...

Viksit Bharat 2026: Fiscal Muscle, Factory Revival, and the War on Speculation

- Market Data