All eyes are curiously focused on the two events, FOMC monetary policy meeting which concludes later today with investors assigning no hike in this monetary policy, likely to remain on hold at 2.50%. However, rising signs of slowing growth in a number of the world’s big economies and US equity markets’ recent hefty losses support the view that the Fed is likely to take a pause in its rate tightening cycle earlier than previously thought.

On the flip side, Bank of England (BoE) is also scheduled, that is not predicted to adjust monetary policy at the meeting on Thursday. The macro picture has worsened somewhat recently, while Brexit uncertainty is still on the table. BoE is likely to maintain its current guidance i.e. limited and gradual hikes going forward.

As Theresa May does not want to abandon the possibility of a third vote in the House of Commons we might see a bizarre compromise that gives her sufficient time to arrange such a vote possibly with further (“clarifying”) letters from Brussels. That makes the time frame during which a no-deal risk is particularly virulent completely unclear once again. That does not exactly make long positions in GBP volatility any more attractive. It is possible that one might have to pay for a long time for the time premium until the development into the one or other direction finally materializes.

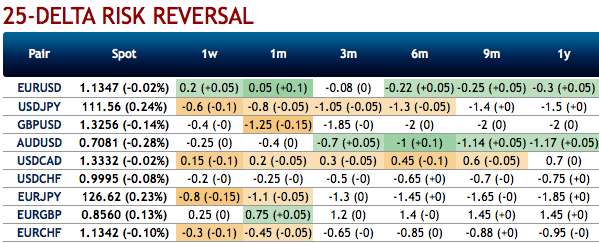

OTC outlook: Thefreshnegative bids are observed in the GBPUSD risk reversals of short-term tenors. While positively skewed implied volatilities of 3m tenors still signal bearish hedging sentiments. To substantiate this downside risk sentiment, risk reversals have also been bearish.

As rightly stated in our previous write-up, it is reckoned that the sterling should not suffer like before, but, one should not completely disregard the hiking cycle on the other hand. The market has always ignored the fact that all the current BoE interest rate moves are due to a favorable result of the Brexit process.

Hence, both the speculators and hedgers of GBPUSD are advised to capitalize on the prevailing price rallies for bearish risks and bidding theta shorts in short run (1m IVs) and 3m risks reversals to optimally utilize delta longs.

Strategic Options Recommendations: On hedging grounds, fresh delta longs for long-term hedging comprising of ATM instruments and OTM shorts in short-term would optimize the strategy.

So, the execution of hedging positions goes this way: Short 1m (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, initiate longs in 3m ATM -0.49 delta put options. A move towards the ATM territory increases the Vega, Gamma, and Delta which boosts premium.

Thereby, the above positions address both upswings that are prevailing in the short run and bearish risks in the long run by delta longs. Courtesy: Sentrix & Saxo

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards -55 levels (which is bearish), and hourly USD spot index has bearish index is creeping at -36 (bearish) while articulating (at 11:56 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  RBA Deputy Governor Says November Inflation Slowdown Helpful but Still Above Target

RBA Deputy Governor Says November Inflation Slowdown Helpful but Still Above Target  U.S. Prosecutors Investigate Fed Chair Jerome Powell Over Headquarters Renovation

U.S. Prosecutors Investigate Fed Chair Jerome Powell Over Headquarters Renovation  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed