Fitch: China Hard Landing Unlikely But Reform Skepticism Rising

Apr 06, 2016 00:05 am UTC| Research & Analysis

Fitch Ratings senior sovereign, banks and corporates analysts addressed the key questions on China most frequently asked by investors, in a Special Report published today. The report includes our views on the prospects for...

Large European banks' oil & gas exposures add to broader earnings challenges

Apr 05, 2016 23:11 pm UTC| Research & Analysis

The energy exposures of the large European banks are moderate and do not present a significant risk to their earnings or capital. However, rising provisions in 2016 will weigh on profitability, says Moodys Investors...

Apr 05, 2016 12:51 pm UTC| Research & Analysis

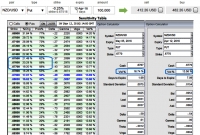

Lets ponder a trader thought implied volatility of ATM EUR/GBP call option of 1W expiries indicate overpriced premiums (see diagram for premiums and its NPV). Thus, it tends to short the volatility. Lets now suppose...

Apr 05, 2016 12:15 pm UTC| Research & Analysis Insights & Views

General business sentiment in New Zealand dropped from +13% in December to -1% in March. This was well below the average level of the last few years, although it was still an improvement on the -11% reading in the...

Moody's: Australian auto ABS and RMBS delinquencies rise in January 2016

Apr 03, 2016 23:18 pm UTC| Research & Analysis

Moodys Investors Service says that delinquencies for Australian auto loan asset-backed securities (ABS) and prime residential mortgage-backed securities (RMBS) rose in January 2016 from December 2015. We expect...

FxWirePro: Is FX OTC really exist for EUR/CHF?, 1W IVs least among G20 space - uphold

Apr 01, 2016 13:20 pm UTC| Research & Analysis

Execution: Short 1W (1%) OTM Put and Short 1W (1%) OTM Call Market Outlook: Less Volatile Lower IVs of ATM contracts have been lacklustre, 4.8% for 1W expiry (the least among G20 currency space). and seems like huge...

FxWirePro: USD/RUB hedging scenario after crude oil holds stronger

Apr 01, 2016 12:13 pm UTC| Insights & Views Research & Analysis

From last two months, crude oil prices have recovered from the bottoms of 26.03 in February to the current 37.29 levels, thanks to production outages in Iraq and Nigeria, faster than expected US shale production declines...

- Market Data