General business sentiment in New Zealand dropped from +13% in December to -1% in March. This was well below the average level of the last few years, although it was still an improvement on the -11% reading in the September quarter, when Fonterra’s milk price forecast was first revised below $4/kg.

Despite the slumping global dairy prices, Fonterra lifted its after tax profit for the half year by 123% to $409 million - as a result of putting more available milk into higher value products.

Over commodity index for New Zealand dropped -1.3% in March, with dairy contributing majority (-4.5%) to the drop. Cheese and butter saw declines of -12.4% and -7.7% respectively, contributing to the woe at a time when global demand is weak.

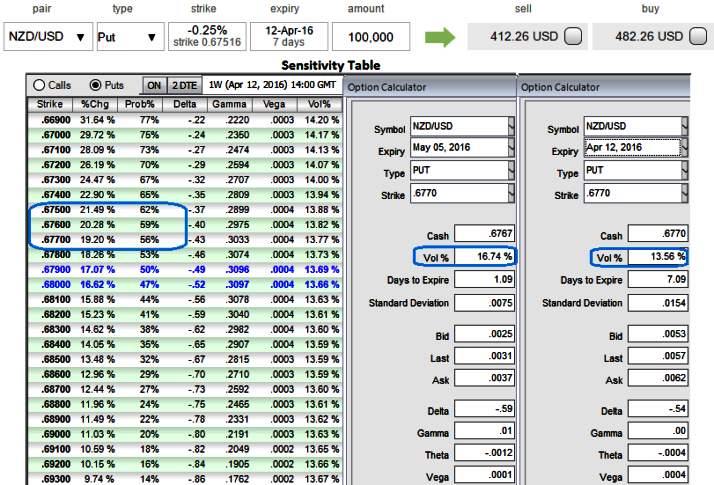

Glance over NZD/USD OTC FX:

ATM IVs of 1W expiries are at 13.56% and 16.74% for 1M tenors, so the volatilities implied in FX option market of this pair is likely to perceive higher volatility times which is good news for option holders.

Because, higher volatility would mean that the option price has moved or is expected to move over a larger range in a set time period.

Subsequently, Have glance on sensitivity table for the different rate scenarios and their probabilistic outcomes. We've just referred 0.25% OTM strikes and their vols, it showed 0.32 as delta values for underlying outrights, that means 32% chances of finishing in-the-money.

More importantly, we've seen rising IVs, as volatility increases, the Delta of an out-the-money option increases.

Hence, 0.25% OTM put options are the best suitable for those we seek hedging instruments for further downside risks.

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics