Execution: Short 1W (1%) OTM Put and Short 1W (1%) OTM Call

Market Outlook: Less Volatile

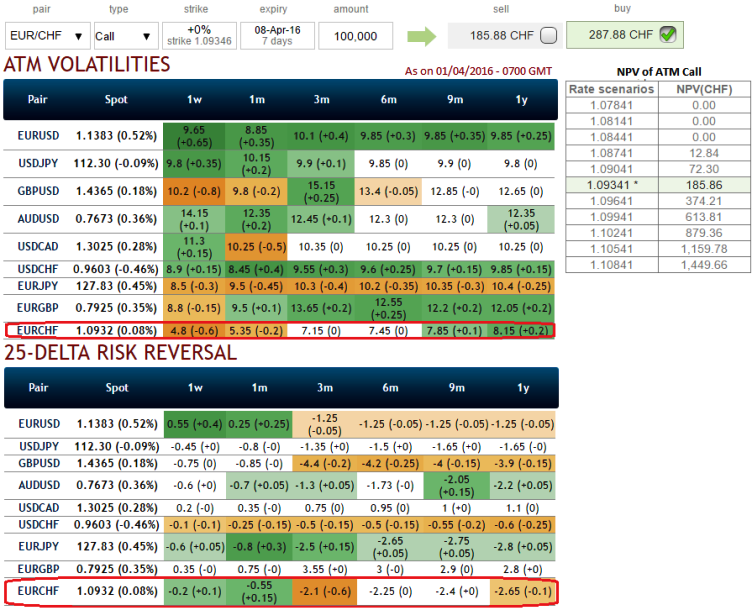

Lower IVs of ATM contracts have been lacklustre, 4.8% for 1W expiry (the least among G20 currency space). and seems like huge disparity exists between option premiums and IVs as the 1W ATM puts have been priced 55% more than NPV which is absolutely absurd, this in turn is a cause of concern as to whether spot FX would move in sync with risk reversals or not.

Rationale: As we foresee narrow range trend is puzzling this pair on both daily and weekly charts.

At current spot at 1.0928, it has been oscillating between the range of 1.0319 on north and 0.9850 on south. So, with range bounded trend and lower IVs keeping in consideration we would like to remain in safe zone by achieving certain returns though shorting a strangle.

Margin: Yes, required.

Description: Trade the expectation of increased volatility without taking a view on direction. A strategy commonly used over major economic announcements and events.

Similar to the Long Straddle, but the break-even points are further apart due to the different strike prices. A Long Strangle is also cheaper.

The OTC options market appeared to be more balanced on the direction for the pair over the 1m to 1y time horizon as hedgers have been cautious on long term downtrend that has lasted since mid April 2013 and as a result delta risk reversal for EURCHF was turning into negative.

Return: The return are certain as long as the underlying spot FX remains between two strikes.

Loss: More losses for the strategy can be experienced if the underlying spot price makes a strong move either upwards or downwards at expiration.

Effect of Volatility: Cash inflow would be certain as volatility decreases and the value of both options will decrease as the volatility rises.

Effect of Time decay: Shorter tenors desirable as the value of both options decay each day that passes.

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics