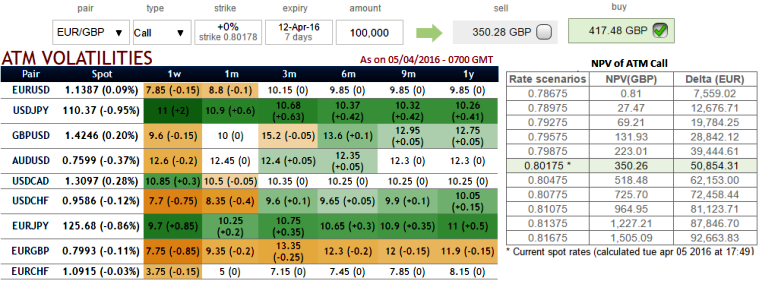

Let’s ponder a trader thought implied volatility of ATM EUR/GBP call option of 1W expiries indicate overpriced premiums (see diagram for premiums and its NPV).

Thus, it tends to short the volatility. Let's now suppose that we are writing an ATM call option with an amount of 100,000 EUR.

Currently, 1W ATM IVs of EURGBP and EURJPY are at 7.75% and 9.7% respectively.

Thereby, ATM premiums of EURGBP are trading 19.14% more than NPV.

The delta is positive 0.5 since this is an ATM EURGBP call option, the amount would be 50,000 EUR in spot outright.

To remove this potential risk taking place when the underlying market moves, we can buy 50,000 EUR against pounds in the spot market anticipating euro to go up and take the opposite position in EURJPY options as it was in EURGBP, because EURJPY is even more bearish with higher implied volatilities as you can probably observe from the IV and risk reversal nutshell.

This allows the delta neutral position. If prediction goes accurate then profit is certain by longs in call option and shots in EURJPY longs in puts with nil risk as the market moves around as long as you continue to update the Delta hedge.

But always keep in mind that adding long in an option in this case would mean that the returns are possible only when volatility spikes as anticipated.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure