Any currency option deal may be equivalently valued as either a call or a put using a parity condition that is specific to currency options. We considered AUDNZD pair to demonstrate the concept, this condition states that:

Holding a call option to buy 1 unit of NZD for x units of AUD is equal to the holding a put option to sell x units of AUD for 1/x units of NZD.

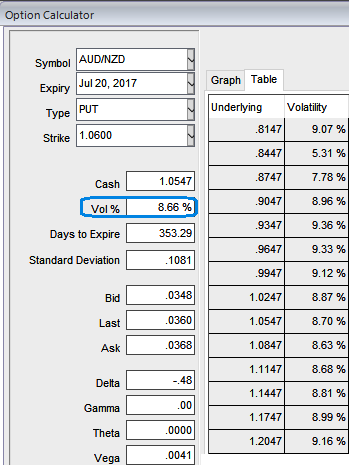

Let’s suppose a foreign trader has purchased NZD (1%) OTM Call / AUD (1%) ITM Put of 1Y expiry in European vanilla style with a face value of AUD $1 million.

The risk-free rate in AUS is +1.44% (3M AUS T-bill),

The risk-free rate in NZ is 2.28% (3M NZ T-bill),

FX rate volatility is at around 8.66%, and let’s say option expiry would be 1 year.

The spot FX is 1.0546 (Direct quote) and the strike rate is 1.06.

Consider AUD as the domestic CCY, so the spot must be quoted as the number of units of NZD required to purchase 1AUD.

To value the option as a call, we treat the AUD as the domestic CCY and the NZD as the foreign CCY. The domestic and foreign interest rates are therefore 1.44% and 2.28%, respectively.

Note that once both the spot and strike quotes are converted, the call option is out of the money.

When these parameters are passed to the Garman-Kohlhagen routine, a value of NZD 0.029181 is returned.

This is a per unit value, and since a total of 1 million Aussie dollars underlie the deal, the total premium value is 0.029181 * 1,000,000 = NZD 29,181(with allowance for rounding).

In order to demonstrate the parity condition, we could also value this deal as a put. In this case, the domestic (foreign) CCY is the AUD (NZD), the domestic (foreign) interest rate is 1.44% (2.28%), the spot rate is 1.0544 and the strike rate is 1.06.

With these inputs, the model returns a value per unit FX of USD 1.0544 and the total value of the premium on the deal is AUD 27,675. This amount is equivalent to the NZD premium computed above when it is converted to NZD at the spot rate of 0.6851.

If the spot FX is expressed in a consistent approach to the strike price, then the computed total premium for the call leg will be the same as the computed total premium for the put leg, assuming both values are expressed in the same currency.

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge