FxWirePro: Two for the spot and two for the OTC to bid for DNTs among G10 FX space

Dec 08, 2017 16:34 pm UTC| Research & Analysis Insights & Views

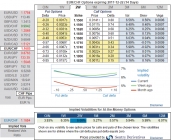

Based on the combinations of four indicators, the suitable currencies are identified for the strongest patterns favouring a DNT trades. The results are demonstrated in above table, where JPY crosses really stand out....

Dec 08, 2017 16:23 pm UTC| Research & Analysis Insights & Views

The safe haven Swiss franc is the notable underperformer in G10 so far this week, having been offered across the board and falling approximately 1.4% against the dollar and approximately 0.6% versus the euro. The...

Dec 08, 2017 15:00 pm UTC| Digital Currency Research & Analysis Insights & Views

All around the world of FinTech arena, the much heated talks on soaring prices of Bitcoin on the back of the launch of cryptocurrency futures trading by the largest derivatives exchange in the world, as well as one of the...

Dec 08, 2017 12:42 pm UTC| Research & Analysis Insights & Views

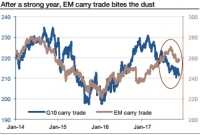

In a context of low yields, depressed volatility and range-bound markets, double-no-touch (DNT) options provide an appealing alternative to the FX carry trade. The current global macro environment is characterized by weak...

Dec 08, 2017 11:36 am UTC| Insights & Views

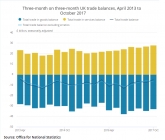

UKs trade deficit widened in the three months to October, data released by the Office for National Statistics (ONS) showed. The deficit for goods and services, excluding erratic commodities such as gold, increased by 0.8bn...

FxWirePro: Speculate AUD/NZD via DNTs and hedge via options strips

Dec 08, 2017 07:54 am UTC| Research & Analysis Insights & Views

AUDNZD medium-term perspectives:Momentum is negative following some AU data disappointments. 1.0950 looks vulnerable. A resumption of the trend rise which started in June should test 1.13, contingent on AU economic data...

FxWirePro: Speculate AUD/NZD via DNTs and hedge via options strips

Dec 08, 2017 07:54 am UTC| Research & Analysis Insights & Views

AUDNZD medium-term perspectives:Momentum is negative following some AU data disappointments. 1.0950 looks vulnerable. A resumption of the trend rise which started in June should test 1.13, contingent on AU economic data...

- Market Data