FxWirePro: Decide precisely whether truth or hype ahead of OPEC meeting

Nov 27, 2017 12:24 pm UTC| Research & Analysis Insights & Views

Crude oil markets are growing nervous, days before OPEC is due to meet in Vienna on 30 November. Front-month prices on ICE Brent are currently retracing around $62.37, down $2.23 from the November highs and putting a pause...

Australia Q3 Capex likely to remain weak, spending on plant and equipment to record solid growth

Nov 27, 2017 11:16 am UTC| Insights & Views

Australian Bureau of Statistics, is set to release Australias Private capital expenditure for the third Quarter. Analysts forecast a decline in Q3 Capex, which is expected to offset the small increases over the previous...

FxWirePro: Spot out headwinds and prospects of yellow metal prices and mitigate potential risk

Nov 27, 2017 09:24 am UTC| Research & Analysis Insights & Views

Macroeconomic trends, specifically monetary policy and central bank commentary, directly impact the dollar and bond markets. Rising interest rates will rise and are a headwind for gold. The current short position in gold...

FxWirePro: Demand/supply equation of gold, price projections and investment flows

Nov 27, 2017 07:43 am UTC| Research & Analysis Insights & Views Central Banks

Gold prices are inching higher towards $1,287 ahead of a significant change of guard in the Federal Reserve this week and establishing the stage for the December meeting extensively anticipated to hike rates. While the...

Nov 27, 2017 07:00 am UTC| Research & Analysis Central Banks Insights & Views

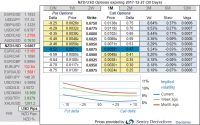

NZDUSD medium-term perspectives:The pair for the day has stalled last weeks rallies and stuck between 0.6850 and 0.6900 (i.e. between 21DMA 7DMA). Hedging interests are mounting ahead of RBNZs financial stability...

FxWirePro: Headwinds/prospects of Platinum prices in 2018 and investment flows

Nov 24, 2017 12:58 pm UTC| Research & Analysis Insights & Views

The long-term price outlook for platinum aligns with current forward prices, and we see the precious metal fairly priced at current levels. More than palladium, platinum remains heavily correlated to gold prices, and...

Nov 24, 2017 12:16 pm UTC| Research & Analysis Insights & Views

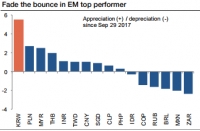

It seems that nothing can stop CNY and KRW, at least for now. KRW strengthened by another 0.2% versus USD this morning. The rate hike expectation in South Korea has triggered the recent sell-off in USDKRW. Some sort...

- Market Data