The “safe haven” Swiss franc is the notable underperformer in G10 so far this week, having been offered across the board and falling approximately 1.4% against the dollar and approximately 0.6% versus the euro.

The surprise 0.1% MoM drop in Swiss CPI in November, the first decline since July, did not stop the annual rate from rising from 0.7% to 0.8%, the highest level since March 2011.

This is eroding the franc's real yield. The SNB may raise its inflation forecast from September when it meets next week on the same day as the ECB.

The CPI is averaging 0.75% so far in 4Q, 0.45pp above the SNB forecast of 0.3% three months ago.

The EURCHF projection is for a return to 1.20 by 2Q’18.

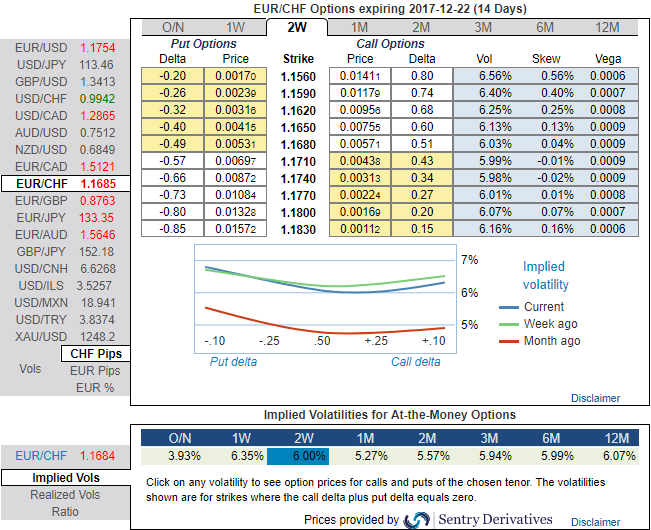

OTC outlook and Options strategy: Before we proceed through the core part of the options strategy, let’s glance through the implied volatilities of EURCHF ATM contracts from the above nutshell, IVs of this underlying pair of all expiries have still been the least among G10 currency segment despite the ECB’s monetary policy announcement and other upcoming data events. These lower volatile conditions are conducive for the option writers.

Amid the prevailing uptrend that we’ve been witnessing in EURCHF, positively skewed IVs of 2w signify the well-balanced hedgers’ interests on either side. Please also be noted that the 25-delta risk reversal of EURCHF does not indicate dramatic shoot up nor any slumps.

Thus, in order to sync with the above fundamental factors, the technical trend of the underlying price and the OTC indications, we advocate below options strategy.

We formulate suitable hedging framework contemplating all the above aspects. Place call ratio spread in 1:2 ratios.

How to execute: At spot reference: 1.1688, buy ITM (1.1480) +0.66 delta call with longer expiry (let’s say 2m tenor). Sell two lots of OTM strike calls (1.2065) of comparatively narrowed tenors (say 1m). Thereby, we’ve formulated the strategy so as to sync ongoing technical trend with the delta risk reversal.

The delta value becomes more and more insensitive as the EURCHF falls lower and lower and hence on the lower side, the delta value is zero.

On the higher side, it increases in magnitude but remains negative indicating the negative effect on the options trader position with the pair rallying.

Why call ratio spread: As the pair has made steep slumps and healthy recovery we see a neutral to bearish environment when you are projecting decreasing volatility (see from next 1 month to 3 months it’s been gradually reducing)

Risk/Reward Profile: The risk is unlimited. The reward is the difference in the strike prices plus the net credit, multiplied by the number of long contracts.

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed