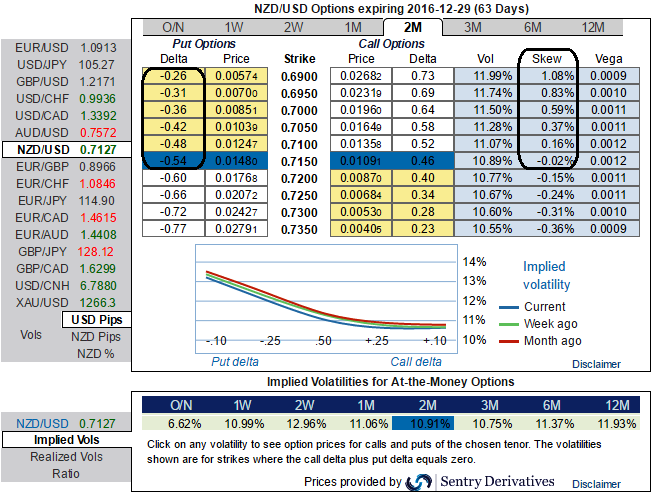

Before we begin with this write-up, please be informed that 2m NZDUSD ATM puts are flashing deltas around -0.54.

NZDUSD has been tumbling considerably offlate, dropped from the highs of 0.7485 to the current 0.7134 levels.

So, the previous consolidation pattern that has lasted about 16-months now seems to have exhausted at this level owing to the potential changes in central banks’ monetary policy decisions in both NZ and the US continents.

As a result, the hedgers who intend to alter their hedging portfolios should be mindful of the premium-adjusted spot delta.

During 2m tenors, any hedging strategies to encompass both the FED and RBNZ easing cycles, US elections, and other routine economic events. Let’s have a glance on IV skewness of this tenor, negatively skewed strikes are less likely to favor holders of such option to serve the desired outcome, in other words, OTM put strikes have the higher likelihood of expiring in the money.

Well, to overcome this hindrance, the premium-adjusted spot delta takes care of the correction induced by payment of the premium in foreign currency (USD in this case), which is the amount by which the delta hedge in foreign currency has to be corrected.

To quantify the hedge in the domestic currency we need to flip around the quotation and compute the dual delta.

As in the case of a spot delta, a premium payment in foreign currency leads to an adjustment of the forward delta. Note again that the premium-adjusted forward delta of a call is not a drone function of the strike.

Forward delta conventions are normally used to specify implied volatilities because of the symmetry of put and call deltas adding up to 100%. Using forward deltas as a quotation standard often depends on the time to expiry T and the presence of an emerging market currency in the currency pair. If the currency pair does contain an emerging market currency, forward deltas are the market default.

This knowledge is crucial to understand the volatility construction procedure in FX markets. In FX option markets it is common to use the delta to measure the degree of moneyness.

Consequently, volatilities are assigned to deltas (for any delta type), rather than strikes. For example, it is common to quote the volatility for an option which has a premium-adjusted delta of 0.25.

These quotes are often provided by market data vendors to their customers. However, the volatility-delta version of the smile is translated by the vendors after using the smile construction procedure.

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.