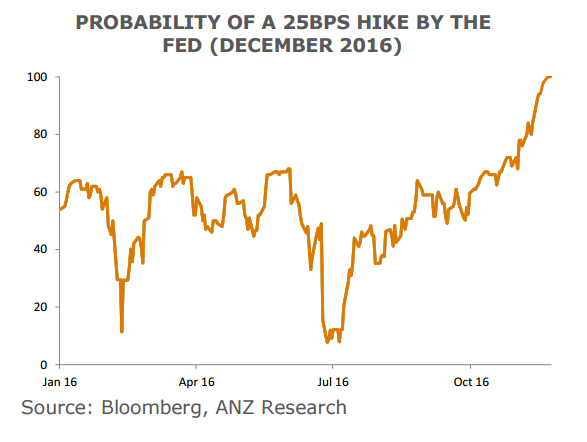

Minutes of the November Federal Open Market Committee’s (FOMC) meeting released on Wednesday were largely unexciting from a near-term policy perspective. After the recent Congressional testimony of Chair Yellen and statements from other Fed officials, the market has fully priced in a rate hike in December. Minutes just cemented December rate hike expectations but did not provide much fodder for markets.

The minutes of the November FOMC meeting noted a hike was seen as appropriate "relatively soon," with some policymakers saying a December tightening was important to "preserve credibility." The Committee did not make any decision regarding the policy framework that the Fed should move toward as policy is normalized and the minutes showed that officials saw no urgency in deciding soon. Thus, current procedures are expected to be maintained for some time.

Participants generally agreed that the case for increasing the target range for the federal funds rate had continued to strengthen. Most participants expressed a view that it could become appropriate to raise the target range for the federal funds rate relatively soon, so long as incoming data provided some further evidence of continued progress toward the Committee’s objectives.

Many members judged that risks to economic and financial stability could increase over time if the labor market overheated appreciably, or expressed concern that an extended period of low interest rates risked intensifying incentives for investors to reach for yield, potentially leading to a mispricing of risk and misallocation of capital”. Fed’s Yellen and Fischer cautioned against expansionary fiscal policy when the economy is close to full employment, arguing that measures aimed at boosting long-term growth would be the best option.

US markets remain closed for Thanksgiving today. USD/JPY hit fresh 8-month highs at 113.53 before slipping to trade at 112.97 at around 12:15 GMT on profit taking. EUR/USD was trading at 1.0573 after making fresh 2016 lows of 1.0518.

FxWirePro's Hourly USD Spot Index was at 42.7604 (Neutral), Hourly EUR Spot Index was at -17.2784 (Neutral) and Hourly JPY Spot Index was at -121.223 (Highly bearish). For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock