FxWirePro: The Day Ahead- 6th October 2017

Oct 06, 2017 05:24 am UTC| Commentary Economy Central Banks

Lots of economic data and events scheduled for today and some with high volatility risks associated. Data released so far: Japan: Labor cash earnings up 0.9 percent y/y in August. Leading economic index improves...

Oct 05, 2017 13:09 pm UTC| Central Banks

The Reserve Bank of India (RBI) upheld its policy rates unchanged at 6.00% yesterday, widely expected by the market. Notably, there has been a remarkable change in RBIs forecast. The central bank cut the growth forecast...

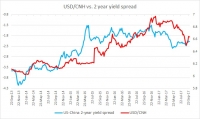

Fundamental Evaluation Series: USD/CNH vs. 2-year yield spread

Oct 05, 2017 10:08 am UTC| Commentary Central Banks

This chart shows the relation between U.S. - China 2-year yield spread and the Dollar/Chinese yuan exchange rate since 2013. It is visible even with naked eyes that the two has enjoyed a very close relationship. It can...

Fundamental Evaluation Series: USD/NOK vs. 2-year yield spread

Oct 05, 2017 07:56 am UTC| Commentary Central Banks

The chart above shows, how the relationship between USD/NOK and 2-year yield spread has unfolded since 2012. It can be seen that the pair and the yield spread between 2-year treasury and 2-year Danish government bond...

Fundamental Evaluation Series: USD/SEK vs. 2-year yield spread

Oct 05, 2017 07:17 am UTC| Commentary Central Banks

The chart above shows, how the relationship between USD/SEK and 2-year yield spread has unfolded since 2012. The Sveriges Riksbank (SRB) began reducing interest rates (repo rates) in the aftermath of the Great...

FxWirePro: The Day Ahead- 5th October 2017

Oct 05, 2017 04:15 am UTC| Commentary Economy Central Banks

Not many economic data and events scheduled for today but some with high volatility risks associated. Data released so far: Australia: Trade balance for August came at 989 million with exports growing 1 percent...

Oct 04, 2017 12:40 pm UTC| Central Banks Research & Analysis Insights & Views

The Polish central bank held its rate decision today: no change in monetary policy was the consensus. The National Bank of Poland announced its reference rate at a record low of 1.5 pct on October 4th, 2017, as widely...

- Market Data