The RBA doesn’t seem to have finished cutting interest rates, and markets should refocus on China woes in H2. AUD/USD is lagging the dovish pricing of rates, the technical picture shows vulnerability and long positioning is stretched.

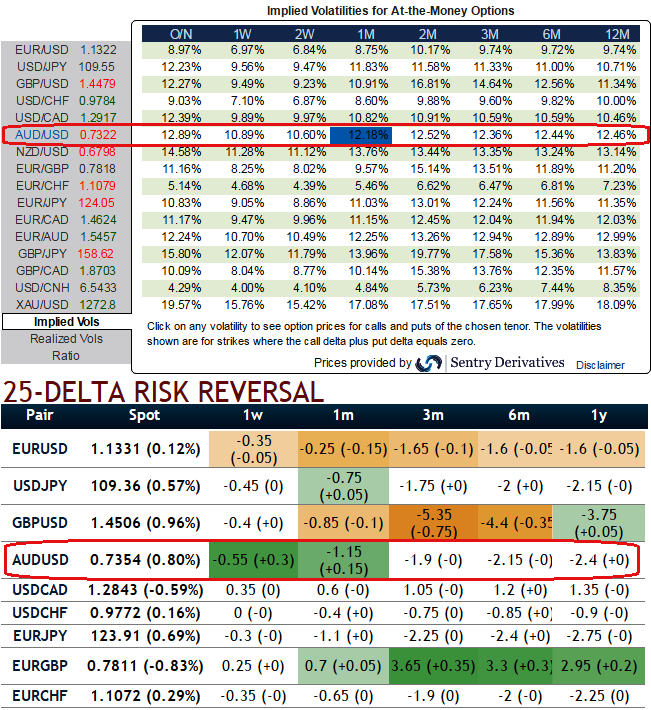

In the volatility space, downside skew is overpriced given the low sensitivity of volatility to spot moves. It suggests selling downside Vega.

Hedging Framework:

Please be aware of IVs of AUD & GBP crosses have been spiking in swift pace over longer period of time, especially for 1m to 1y tenors. In AUDUSD, we could very well observe a new rising hedging positioning for 1m tenors for bearish risks.

The gradual rise over long run could be viewed as better opportunity for options strategies using knock in strikes and narrow expiries.

We recommend Buying a 3m put strike 0.72 with a knock-out set at 0.77, two figures below the year-to date low.

Buy AUD/USD 3m/1m put strike 0.72, knock-out 0.77, indicative offer: 0.60% (vs 2% for the vanilla, spot ref: 0.7334).

Risks associated with trade: AUD/USD falling below year-to-date low within no time. Investors buying a knock-out option cannot lose more than the premium initially invested. The option will however cease to exist if AUD/USD touches 0.77 at any time before the 3m expiry.

The recommendation for buying an AUD/USD 1m put strike 0.72 with a topside knock-in at 0.7770. The option was duly activated as the spot culminated at 0.7828 levels two weeks later before subsequently declining.

Unfortunately, this 1m option expired too early to deliver a positive payoff, as the spot was just above the strike at this time. We think that this is an ideal timing right now to reset bearish AUD positions via options as you can probably understand OTC sentiments of AUDUSD pair through delta risk reversal numbers, since the RBA is not finished making cuts and China woes should undermine confidence too again in H2.

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty