Japanese CPI – deflationary headline with inflationary core

Sep 25, 2015 07:37 am UTC| Insights & Views

Japan released its consumer price index report that shows Japans economy is struggling with deflationary pressure, which poses questions over the success of Bank of Japans (BOJ) ultra-easy monetary policies. Deflation...

Guide to today’s important data and events

Sep 25, 2015 06:27 am UTC| Insights & Views

Not many economic dockets to be released today, focus on US GDP data. Upcoming France - Consumer confidence for September to be released at 6:45 GMT. Prior reading 93 in August. Germany - Bundesbank president...

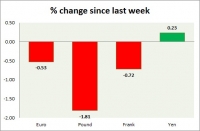

Currency snapshot (major pairs)

Sep 24, 2015 18:13 pm UTC| Insights & Views

Dollar index trading at 95.85 (-0.36%). Strength meter (today so far) - Euro +0.40%, Franc +0.45%, Yen +0.45%, GBP -0.03% Strength meter (since last week) - Euro -0.53%, Franc -0.72%, Yen +0.23%, GBP -1.81% EUR/USD...

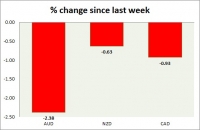

Currency snapshot (commodity pairs)

Sep 24, 2015 17:56 pm UTC| Insights & Views

Dollar index trading at 95.79 (-0.41%) Strength meter (today so far) - Aussie +0.20%, Kiwi 1%, Loonie -0.12%. Strength meter (since last week) - Aussie -2.38%, Kiwi -0.63%, Loonie -0.93%. AUD/USD - Trading at...

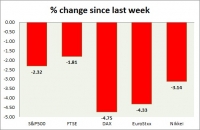

Sep 24, 2015 17:28 pm UTC| Insights & Views

Equities are all trading in red today. Performance this week at a glance in chart table - SP 500 - SP 500 sold off sharply after initial gains. Focus is on Janet Yellens speech later today. Todays range 1947-1908. SP...

Sep 24, 2015 16:55 pm UTC| Insights & Views

Energy pack is mixed, while gas is down, oil is trading in green today. Weekly performance at a glance in chart table. Oil (WTI) - WTI is trading in tight range, up today after yesterdays large sell off. Price action...

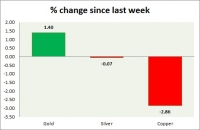

Commodities snapshot (precious & industrial)

Sep 24, 2015 15:56 pm UTC| Insights & Views

Metal pack is trading in green today. Performance this week at a glance in chart table - Gold - Gold is sharply up today, as investors brace yellow metals protection against volatility and uncertainty. Todays range -...

- Market Data