Sep 25, 2015 12:18 pm UTC| Insights & Views

Bonds across globe were the best performer after US Federal Reserve chose to wait for further improvement in inflation and abroad before pulling the trigger last week, however reverses some of the gains this...

Sep 25, 2015 11:45 am UTC| Insights & Views

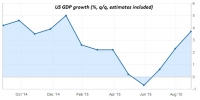

Today final estimate of US second quarter GDP will be released at 12:30 GMT. After contraction of -0.2% in first quarter market is expecting improved second quarter for US economy. Past trends US GDP picked up...

Key extracts from FED chair Yellen’s speech

Sep 25, 2015 11:07 am UTC| Insights & Views Central Banks

US Federal Reserve chair Janet Yellen last night gave speech on inflation dynamics and monetary policy at university of Massachusetts, Amherst. Due to not feeling well over dehydration, madam chair hasnt been able to...

Fiscal headwinds to weigh on Cable over the coming year

Sep 25, 2015 11:06 am UTC| Insights & Views Central Banks

Risks to Britains financial stability have risen over the past three months, driven by developments in China and other emerging markets. The combination of low inflation, the consequent rise in real interest rates and GBP...

Verbal intervention leads Brazilian Real to post biggest rally in seven years

Sep 25, 2015 10:28 am UTC| Insights & Views

"Do, whatever it takes", and "use all possible instruments" are the most popular central banks verbal intervention phrases, which are sure shot success, definitely in the short term, even if not in the medium or long...

Gold loses charm as equities recover

Sep 25, 2015 09:43 am UTC| Insights & Views

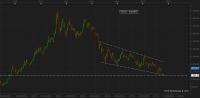

Gold has lost its shine today as risk appetite returned to market, pushing the yellow metal lower. Gold has gained sharply over past few trading days from $1100/troy ounce to $1157/troy ounce. The move has been quite...

Monetary policy divergence back at play with risk-on return

Sep 25, 2015 08:47 am UTC| Insights & Views

With Equities recovering around the world, familiar themes are again back in play. Monetary policy divergence and risk off is looking to be most prominently dominating todays trade. It has been showing signs of return...

- Market Data