Dollar index trading at 95.85 (-0.36%).

Strength meter (today so far) - Euro +0.40%, Franc +0.45%, Yen +0.45%, GBP -0.03%

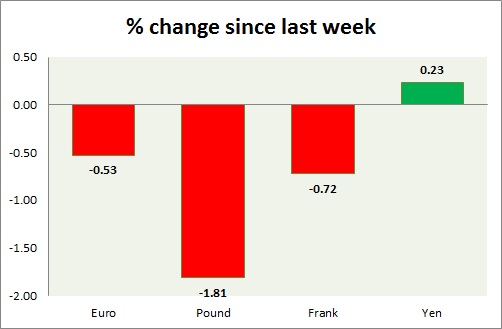

Strength meter (since last week) - Euro -0.53%, Franc -0.72%, Yen +0.23%, GBP -1.81%

EUR/USD -

Trading at 1.123

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range

Support

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.08-1.085

Resistance -

- Long term - 1.175-1.18, Medium term - 1.15, Short term - 1.15

Economic release today -

- NIL

Commentary -

- Euro traded as high as 1.1296 against Dollar, however sharp selloff from earlier rising channel led to drop in Euro.

GBP/USD -

Trading at 1.524

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.518-1.512,

Resistance -

- Long term - 1.592-1.616, Medium term - 1.585, Short term - 1.572

Economic release today -

- NIL

Commentary -

- Pound is the worst performer today and this week as investors pose doubts over promise by BOE officials to hike rates. However selloff is showing signs of slowdown Active call - Sell Pound targeting 1.44 area with stop loss around 1.58 area.

USD/JPY -

Trading at 119.7

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Range

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 118

Resistance -

- Long term - 130, Medium term - 127.5, Short term - 124.5, Immediate - 122

Economic release today -

- Flash reading showed PMI to drop in September to 50.9 from 51.7 in August.

Commentary -

- Yen is failing to secure large bids over equities selloff as gold is attracting investors. Active call - Sell USD/JPY targeting 114.7 area with stop loss around 122.

USD/CHF -

Trading at 0.975

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 0.88, Medium term - 0.90, Short term - 0.93

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987

Economic release today -

- NIL

Commentary -

- Franc is best performer today, gaining from safe haven bids over equity sell offs.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand