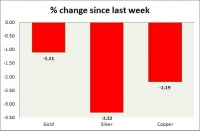

Commodities snapshot (precious & industrial)

Sep 28, 2015 16:33 pm UTC| Insights & Views

Metal pack is trading in red today. Performance this week at a glance in chart table - Gold - Gold dropped sharply failing to gain over equity sell offs. Todays range - $1148-$1127 Gold is currently trading at...

Currency snapshot (major pairs)

Sep 28, 2015 16:26 pm UTC| Insights & Views

Strength meter (today so far) - Euro +0.32%, Franc +0.49%, Yen +0.61%, GBP +0.19% Strength meter (since last week) - Euro +0.32%, Franc +0.49%, Yen +0.61%, GBP +0.19% EUR/USD - Trading at 1.123 Trend meter - Long...

FED’s Dudley rejects criticism over forward guidance reiterates 2015 rate hike

Sep 28, 2015 15:06 pm UTC| Insights & Views Central Banks

William C Dudley, President at New York Federal Reserve, has rejected the criticism that FED is creating more confusion over its rate hike communication. Expectations of rate hike from FED was initially focused on June,...

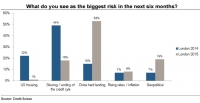

European Investors’ worrying on China rose 38% in 2015, from a year ago

Sep 28, 2015 14:30 pm UTC| Insights & Views

A survey by Credit Suisse show that European investors are clearly more worried on China than anything else for the matter. Similar survey by Barclays, published earlier this month showed fund managers are most worried...

Merkel’s’ popularity declines over her handling of refugee crisis

Sep 28, 2015 13:48 pm UTC| Insights & Views

Two separate survey showed that Germanys popular leader, Chancellor Angela Merkels popularity is in decline that is due to her handling of European Refugee crisis. Initially Ms. Merkel extended generous welcome to...

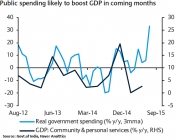

FxWirePro: Conducive Indian fiscal policies to drive growth - long 15y government bonds

Sep 28, 2015 13:10 pm UTC| Insights & Views

Given the revenue boost from rising indirect tax receipts (+35.3% y/y fiscal YTD), which reflects a surge in excise and services tax collections, expenditure momentum has picked up considerably, leading a revival in the...

Sep 28, 2015 12:54 pm UTC| Insights & Views Central Banks

Reserve Bank of India (RBI) is expected to announce monetary policy decisions at 5:30 GMT tomorrow, which will follow speech from Governor Raghuram Rajan. After three rate cuts so far this year, market is expecting...

- Market Data