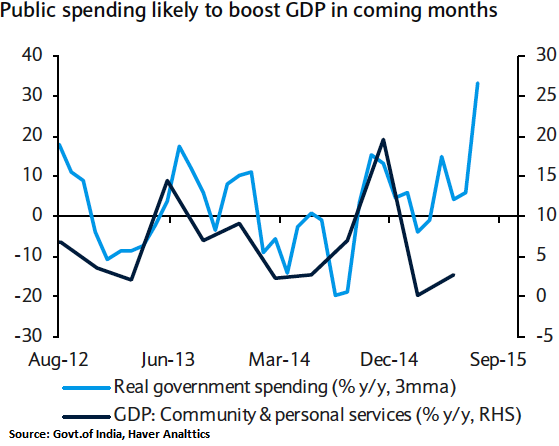

Given the revenue boost from rising indirect tax receipts (+35.3% y/y fiscal YTD), which reflects a surge in excise and services tax collections, expenditure momentum has picked up considerably, leading a revival in the capex cycle.

Government expenditure has risen sharply, led by a jump in both capital and revenue spending - central government expenditure (less interest payments) has risen 35% YoY which in turn contributed to healthy GDP growth. GDP grew 7.0% y/y in Q2 2015.

Implementation of a goods and service tax (GST) remains a critical milestone for the reform agenda

Relying on below driving forces that ensure to maintain current fiscal policies in long run, we target the 10y Indian government bonds yield at 7.25% by year-end (current: 7.75%).

Sharp disinflation has opened room for rate cuts

Demand-supply dynamics are being boosted by ongoing fiscal consolidation

Normalizing household financial savings and higher FII limits

India's fiscal policy is turning more growth-supportive, in sharp contrast to the past four years of deficit compression and austerity.

We project the INR to remain an EM FX outperformer on a total return basis and forecast USDINR to reach 68.3 by end 2015. Lower oil prices have brought about improvements in India's current account and fiscal balances, and we see scope for more rate cuts to support growth. However, the RBI will remain mindful of REER strength.

FxWirePro: Conducive Indian fiscal policies to drive growth - long 15y government bonds

Monday, September 28, 2015 1:10 PM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?