USD strength renews if and when the Fed lifts off

Jul 02, 2015 06:40 am UTC| Commentary

A second important macro driver in H2 should be US monetary policy, the FOMC is expected to start the lift-off in rates, most likely in September. A Fed tightening cycle should not be especially menacing for global...

US unemployment rate to sink in June

Jul 02, 2015 06:05 am UTC| Commentary

The US unemployment rate data for June is due on today.Societe Generale estimates, the unemployment rate likely to decline from 5.5% to 5.4%, which would reverse the unexpected uptick in May and put it back at the cyclical...

Australia's May retail sales growth likely to post solid trend

Jul 02, 2015 05:46 am UTC| Commentary

Australias retain sales data for May is scheduled to release on 3rd, July.Despite stagnating in April, an expansion in May retail sales is expected, but merely in line with trend at 0.3% mom (identical to the average gain...

Global agricultural prices drive Brazil's food inflation up

Jul 02, 2015 05:35 am UTC| Commentary

Inflation acceleration continued in Q2 despite the likelihood that adjustments to the prices of regulated goods and services are nearly over. The bulk of the upside surprise in May and June (based on the IPCA-15 release...

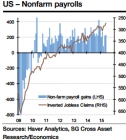

Steady progress continues in US June payrolls

Jul 02, 2015 05:18 am UTC| Commentary

The BLS is expected to report that US nonfarm payrolls expanded by 210k in June, but broadly in line with the YTD average of 217k. Although job openings rose to a new record high in April, jobless claims suggest that the...

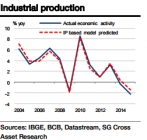

Brazil's Industrial production to fall at substantial pace in Q2

Jul 02, 2015 05:12 am UTC| Commentary

Assuming the same IP rate sustains as per first four months for the rest of the year, Brazils supply side economic activity index should fall by -1.5% in 2015. However, year-to-date economic activity has collapsed slightly...

Brazil's inflation trending upward on fundamentals

Jul 02, 2015 05:05 am UTC| Commentary

Inflation has been on an upward trajectory since 2009 (for a number of structural reasons - labour market rigidities and low productivity growth, low domestic savings and fiscal profligacy).Even after assuming that real...

- Market Data