Banxico rate decisions in key commodity producers

Jul 24, 2015 03:30 am UTC| Commentary

Banxico recently adjusted its monetary policy meeting calendar in order to make a decision right after the FOMC meetings. Accordingly, next week there will be Fed decision on July 29 and Banxico will meet on July 30.The...

Central Bank of Russia rate decisions in key commodity producers

Jul 24, 2015 03:26 am UTC| Commentary

A gradual path of rate cuts from the CBR appears justified following the real sector data last week that suggest tentative signs of bottoming. The oil (Brent) in RUB terms has fallen 8% since the end of June, which will...

Mexico's subdued inflation set monetary policy dilemma

Jul 24, 2015 01:56 am UTC| Commentary

Mexico inflation remains subdued, and recently, it has surprised the markets on the downside, reducing market expectations for the year-end print. In particular, CPI increased 0.09% 2w/2w in the first half of July as a...

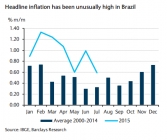

No rest for Brazil's inflation, at least for now

Jul 24, 2015 01:47 am UTC| Commentary

Barclays notes:The recent inflation prints in Brazil surprised on the upside, as food prices seasonally experience a decrease between the months of May and July, driving headline inflation lower. This year, however, food...

MERS drives Korea's consumption lower in Q2 GDP

Jul 24, 2015 01:23 am UTC| Commentary

Barclays notes:Koreas advance estimate of Q2 15 GDP showed weak growth of 0.3% q/q sa (Q1: 0.8%; Q4 14: 0.3%). On an annualised basis, growth slowed to 1.2% q/q saar (Q1: 3.3%; Q4: 1.1%), which translates into 2.2% y/y...

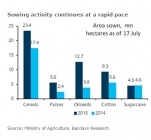

India monsoon tracker: Rainfall improves at the margin

Jul 24, 2015 00:56 am UTC| Commentary

Barclays notes:The south-west monsoon rains improved after a poor run of three weeks. Cumulative rainfall between 1 June and 23 July was 7% below normal, improving marginally from the 8% shortfall last week. However, the...

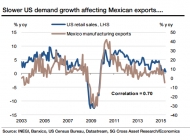

Mexican manufacturing growth expected to improve in H2, but uncertainty has risen lately

Jul 24, 2015 00:29 am UTC| Commentary

Societe Generale notes:We remain hopeful of a bounce back in H2 and are still somewhat hopeful of decent Q2 growth also given the strength of the domestic consumption demand (as seen in retail sales numbers) so far this...

- Market Data