Barclays notes:

The south-west monsoon rains improved after a poor run of three weeks. Cumulative rainfall between 1 June and 23 July was 7% below normal, improving marginally from the 8% shortfall last week. However, the geographic distribution has not changed much, with now 24 out of 36 regions reporting normal rainfall conditions, with another 8 close to normal levels. July is currently running 24% below normal, after June recorded rainfall that was 19% above normal.

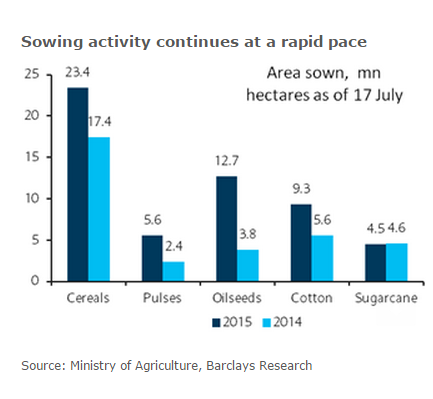

July-August remain the key months for monsoons, and next four weeks account for ~29% of total seasonal rainfall, before tapering off. The Indian Meteorological Department (IMD has maintained its forecast that this season's rains are likely to be 88% of the long-period average. Overall sowing activity for food remains robust and was up ~62% relative to 2014 as of 17 July, with strong increases seen in pulses (~134%) and oilseeds (~234%). On the back of the sowing momentum, price increases for pulses have already started to slow.

In its last policy statement, the Reserve Bank of India (RBI) noted that monsoon-related risks dominate its concerns around inflation. However, the governor recently noted that the progress of the monsoon this year has been good, and he is likely to reiterate that message at the next policy meeting on 4 August. In that context, the significant improvement in crop sowing activity, along with subdued increases in MSPs in mid-June for the summer crops, is going to help with food price management. Despite the upside surprise in June inflation, we forecast FY 15-16 average CPI inflation to be 5% (H1 FY 15-16: 4.5%, H2 FY 15-16: 5.5%). We expect monetary policy in the coming months to remain data dependent. The risk of another cut in H2 FY 15 remains, in our view. However, a potential cut will remain contingent on greater clarity on a number of factors, including trends in commodity prices, the monsoon outcome, the likely 2016 inflation trajectory and the impact of a potential Fed rate hike, possibly in H2 15

India monsoon tracker: Rainfall improves at the margin

Friday, July 24, 2015 12:56 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed