Commodity currencies at multi-year low

Oct 15, 2015 06:38 am UTC| Commentary

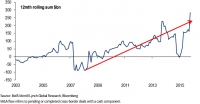

The commodity currencies are at multi-year lows, having tracked the fall in global commodities. The falling terms of trade and prospects of lower investment going forward leave the risk ahead. However, with the major...

EUR/GBP levels looks increasingly attractive

Oct 15, 2015 06:33 am UTC| Commentary

Though UK 3Q GDP projections (to 0.5% q/q) were revised, the broader array of economic variables continues to show signs of strength, especially the domestic economy. BRC like-for-like store sales for example, rose 2.6%...

Amortisation requirement unlikely to have a material impact on Sweden's home prices

Oct 15, 2015 06:29 am UTC| Commentary

In sweden, apart from an amortization requirement, which likely will be implemented as from May 2016, no important measures are expected on the macrofinancial stability front. There are at least three reasons why the...

Oct 15, 2015 06:12 am UTC| Commentary Technicals

Growing China woes and the continued fall in commodity prices have put massive pressure on the ZAR. Risks of further ZAR weakening remain high near term, not least from the approaching Fed hike. USD/ZAR is targeted at13.7...

Upward revisions to Chile's inflation forecasts

Oct 15, 2015 06:11 am UTC| Commentary

Chile year-ahead inflation expectations have moved up in recent months although the longer term inflation trajectory remains closer toBCChs target.The substantial depreciation of Chilean peso has stopped inflation...

Chile's August growth number shows why tightening won’t be easy decision

Oct 15, 2015 06:05 am UTC| Commentary

Chiles August growth number simply raised the uncertainty about whether the economy has bottomed yet. Simultaneously, it also means that that inflation situation will be the only concern in the near term if the BCCh indeed...

Risks to South Africa's medium-term inflation outlook

Oct 15, 2015 05:56 am UTC| Commentary

The surprising contraction of the South Africas economic activities in Q2 made the probabilities of a September hike of 25 bp start to fade away, and it looks more possible the SARB will stay on hold at the next meeting....

- Market Data