Though UK 3Q GDP projections (to 0.5% q/q) were revised, the broader array of economic variables continues to show signs of strength, especially the domestic economy. BRC like-for-like store sales for example, rose 2.6% YoY in September, which was the strongest reading in six months.

The domestic conditions for higher rates are now in place, but arguments for an immediate and sustained rally in GBP based on rate differentials are weak. Levels in EUR/GBP are looking increasingly attractive to establish medium-term shorts based on the policy divergence framework and given relatively light positioning in the pair.

"This view would be preferred to express via options strategies rather through spot as the path toward the year-end forecast of 0.71 is unlikely to be a straight one. The European economists still look for action by the ECB before the end of the year and the UK rates market has pushed back rate hikes too far into 2016 than UK domestic fundamentals would justify", says Bank of America.

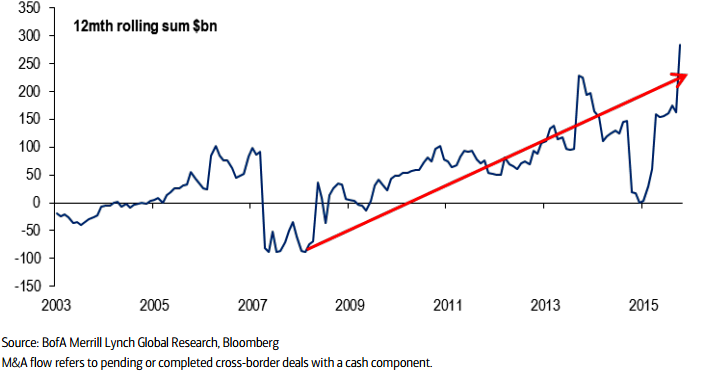

Recent cross-border M&A news flow could also be an important driver for GBP. The trend improvement in net cross-border M&A flows into the UK since the financial crisis where cash is a component. In terms of flows (and from a current account deficit financing perspective) GBP should find some flow support.

EUR/GBP levels looks increasingly attractive

Thursday, October 15, 2015 6:33 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX