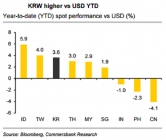

USD/KRW seen at 1,150by end-2016; BoK likely to maintain status quo

Oct 25, 2016 09:30 am UTC| Commentary Economy

USD/KRW is likely to trade at around 1,150 by end of this year; with the Fed likely to hike interest rates in December, we see upside risk to USD-KRW. The market is currently pricing in 71 percent chance of a hike by...

Swedish producer prices fall in September, weakened SEK to boost consumption goods prices

Oct 25, 2016 09:05 am UTC| Commentary

Swedish manufacturers producer prices were little changed in September. Producer prices in total dropped 0.1 percent year-on-year in September as compared with the decline of 0.3 percent in the prior month. Sequentially,...

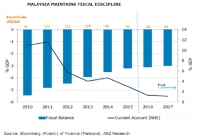

Malaysia maintains fiscal discipline; USD/MYR likely to trade around 4.15 by end-2016

Oct 25, 2016 08:46 am UTC| Commentary Economy

The Malaysian government underlined their commitment to fiscal consolidation when they unveiled Budget 2017 last week. Cutbacks to spending for this year were outlined to keep the fiscal deficit at 3.1 percent of the gross...

INSEE French business climate indicator stable in October

Oct 25, 2016 08:43 am UTC| Commentary

Frances business climate indicator came in stable in October 2016 for the second straight month. According to the official statistics office INSEE, the composite indicator, which is compiled from the answers of business...

S. Korean bonds slump as Q3 GDP beats estimates despite Samsung recalls, Hyundai strikes

Oct 25, 2016 08:35 am UTC| Commentary

The South Korean government bonds slumped Tuesday after recent data showed that the countrys third-quarter gross domestic product (GDP) rose higher than market expectations despite crapping of Samsung Electronic Co Ltds...

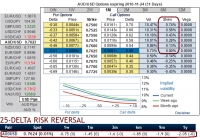

Key factors at play in gold market

Oct 25, 2016 07:42 am UTC| Commentary

Gold has suffered a serious setback after it failed to break above a key resistance around $1380 in June and since then it has struggled to maintain the upside pressure. $1300 area acted as key support until late...

Oct 25, 2016 07:33 am UTC| Commentary

The stakes are high this week. A big shift in the trajectory of inflation in Australia would threaten both our view that the market will not move to price in hikes into the OIS strip, and that the AUD remains capped, with...

- Market Data