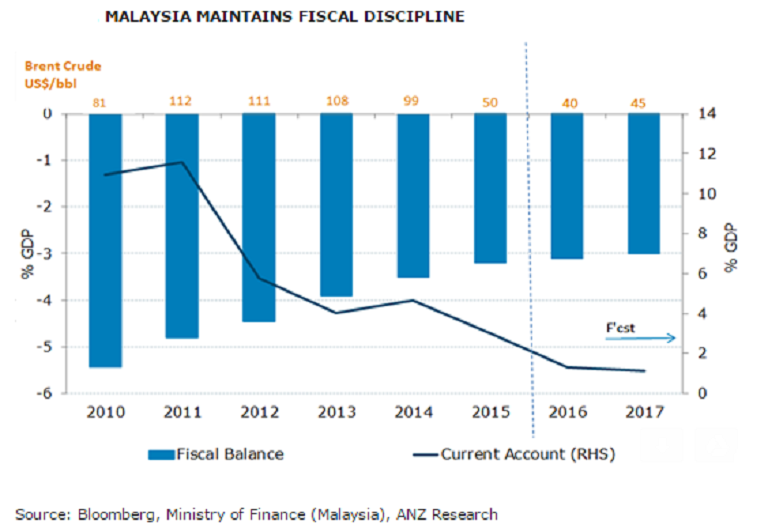

The Malaysian government underlined their commitment to fiscal consolidation when they unveiled Budget 2017 last week. Cutbacks to spending for this year were outlined to keep the fiscal deficit at 3.1 percent of the gross domestic product (GDP) in 2016, with a slight improvement to 3.0 percent in 2017 forecast.

This display of fiscal discipline puts Malaysia’s sovereign credit rating of A- (stable outlook) on a firm footing, particularly with the diversification of its revenue base away from oil. Given that Budget 2017 is supportive of private consumption, Bank Negara Malaysia (BNM) is expected to leave the overnight policy rate unchanged at 3.00 percent at the final meeting of the year on November 23.

Also, the ringgit has underperformed, below market expectations. MYR’s weakness is notable in light of the rebound in oil prices. Despite expectations of rebound in oil prices that prices will stay above USD50/bbl, the near-term outlook for the MYR remains challenging, ANZ reported.

Further, the narrowing in the current account surplus provides less support for the ringgit. US monetary policy normalization and a steeper yield curve in the major developed markets will result in more volatile capital flows.

"For now, we maintain our year-end USD/MYR forecast at 4.15, as we look for some near-term retracement. But the risk is clearly tilted towards further ringgit weakness," ANZ commented in its latest research report.

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran