USD/KRW is likely to trade at around 1,150 by end of this year; with the Fed likely to hike interest rates in December, we see upside risk to USD-KRW. The market is currently pricing in 71 percent chance of a hike by December as compared to 60 percent at the start of the month.

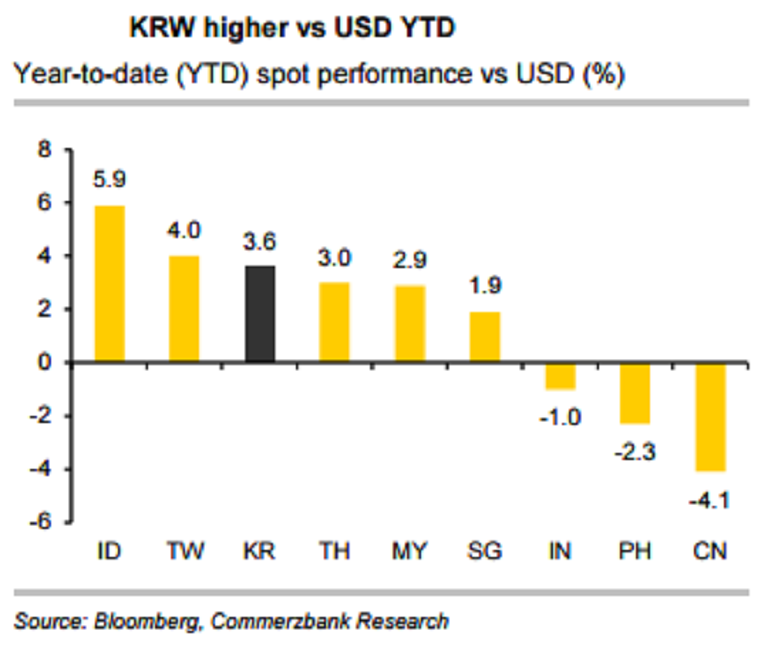

On the FX front, the KRW has strengthened by 3.6% against the USD on a year-to-date (YTD) basis. This makes it the third best performing Asia ex-Japan currency, behind the IDR (+5.9%) and TWD (4.0%) and above the average of 1.5% for the Asia ex-Japan currencies.

The main driver was foreign inflows into the domestic market, following the Fed’s change in stance in March and June. The inflows were also helped by improving sentiment following S&P’s credit rating upgrade in August. On a YTD basis, a combined 22.6bln USD has entered the stock and bond market, the highest in the five countries tracked by Bloomberg.

Further, Bank of Korea (BoK) Governor Lee said recently that the central bank still has space for monetary easing despite rates being at all-time lows and that further cuts would be warranted if the ongoing restructuring effort triggers recession concerns. He also played down expectations that the central bank would resort to the use of Quantitative easing (QE).

"At this stage though, we don’t see an urgent need for BoK to cut rates with growth still seen at around its forecast range," Commerzbank commented in its latest research report.

Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022