Dec 28, 2018 13:12 pm UTC| Research & Analysis Central Banks

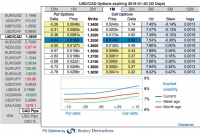

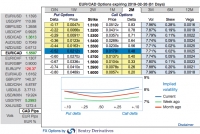

Ahead of BoCs monetary policy on 9thJanuary, loonie still appears to be weaker, testing fresh lows into Christmas and New Year holidays. CAD is fundamentally vulnerable as crude oil prices hit fresh lows; liquidity...

Dec 27, 2018 10:55 am UTC| Research & Analysis Central Banks

Canadian central bank is scheduled on January 09th, for BoC to be repriced by a hike as a partial catch up to the Feds level and pace, and for some momentary positive risk premium assisted by a covering of...

Dec 24, 2018 13:32 pm UTC| Research & Analysis Central Banks

CADJPY slides past 81.600 levels, heading towards to hit 8-months lows as a dovish statement from the Bank of Canada is most likely in its upcoming monetary policy that is scheduled on 09thJan 2019. Investors slashed odds...

Fundamentals to watch out for this week

Dec 24, 2018 12:49 pm UTC| Commentary Central Banks

In terms of volatility risks, this week is very light as we head into the Christmas holiday week. As a trader you need to keep a watch on the followings, What to watch for over the coming days: Central Banks: Bank...

Fed Hike aftermath Series: Hike probabilities over coming meetings

Dec 24, 2018 07:05 am UTC| Commentary Central Banks

FOMC increased interest rates in March, June and in September. Increased its forecast from three rate hikes in 2018 to four rate hikes. September decision was unanimous. Current Federal funds rate - 225-250 bps (Note, all...

FxWirePro: Vols forecasting in 2019 - Long-end USD/JPY vols appear cheaper for strategic vega longs

Dec 24, 2018 06:47 am UTC| Research & Analysis Central Banks

As widely anticipated, the Fed hiking cycle continued once more this year as FOMC raised rates by 25 bps (Feds Funds rate 2.50%). At the same juncture, the Feds dot plot moved lower over the forecast horizon. These...

The Fed cares when the stock market freaks out – but only when it turns into a bear

Dec 21, 2018 11:12 am UTC| Insights & Views Central Banks Economy

Stocks have been falling for more than two months, with investors all but begging the Federal Reserve to stop lifting short-term interest rates. Higher rates hurt stocks by making other, less risky investments look more...

Viksit Bharat 2026: Fiscal Muscle, Factory Revival, and the War on Speculation

- Market Data