RBA monetary policy: Assessing future bias

May 07, 2019 11:28 am UTC| Commentary Central Banks

Reserve Bank of Australia (RBA) chose to keep the interest rate unchanged at 1.5 percent at todays policy meeting. Lets look at the details of the policy announcement to assess the bias of RBA. Key highlights...

FxWirePro: A Run Through on Luring Relative Values in Kiwis FX Crosses Ahead of RBNZ

May 07, 2019 11:16 am UTC| Research & Analysis Central Banks Insights & Views

By year-end, we expect NZD to see it below 0.6600 levels if the RBNZ cuts the OCR. In addition, we expect the US economy to improve in the second half of 2019, which should support the US dollar. Currently, our...

May 07, 2019 08:45 am UTC| Research & Analysis Central Banks

The Reserve Bank of Australia (RBA) maintained the status quo in its monetary policy, leaving key rates unchanged today. As a result, the Aussie dollar could be a beneficiary slightly from this decision as the majority of...

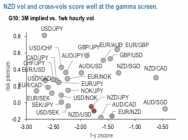

FxWirePro: Prime focus on Gamma among Antipodean FX bloc ahead of RBNZ

May 07, 2019 07:01 am UTC| Research & Analysis Central Banks

The Reserve Bank of Australia (RBA) left its key rate unchanged today. The Australian dollar was able to benefit slightly from this decision as the majority of analysts had expected a rate cut. While the RBNZ surprised...

May 07, 2019 04:07 am UTC| Commentary Central Banks

Reserve Bank of Australia (RBA) will announce its monetary policy decisions today at 4:30 GMT. Economy at a glance The economy is growing at 2.3 percent y/y as of Q4 2018 compared to 4.3 percent in early 2012....

On rate-cut Tuesday, here are four reasons why the Reserve Bank shouldn't jump

May 07, 2019 03:08 am UTC| Insights & Views Central Banks

Every first Tuesday of every month but January the Reserve Bank Board meets to decide whether to adjust interest rates. It announces its decision at 2.30 pm eastern time. It ought to be an easy decision. Officially, the...

FxWirePro: NOK vulnerable on falling oil prices – Call check on EUR/NOK/USD options triangle

May 06, 2019 13:42 pm UTC| Research & Analysis Central Banks

TheNOKcontinued to weaken last week, and theEURNOKhas traded back above the 9.80-handle going into this week, after trading as low (strong) as 9.55 two weeks ago. The main reason for the NOK weakness last week was...

- Market Data