FxWirePro: EUR/SEK lacklustre IVs lure “CCS” during crayfish party for both speculation and hedging

Jul 14, 2016 13:08 pm UTC| Research & Analysis Insights & Views

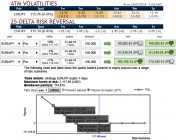

We reckon that the major uptrend of EURSEK and the abrupt bear swings could be efficiently tackled by the below option strategy. As shown in the diagram, the ATM IVs of this pair have been anextremely lower side which...

FxWirePro: EUR/USD tactical positioning in options investing – Optimize convexity and volatility

Jul 14, 2016 12:54 pm UTC| Research & Analysis Insights & Views

The implied volatility of ATM contracts for 1M-3M expiries of this the pair is flashing at around 8.4%. While current 1w IVs of ATM contracts of EURUSD crossfor 1W expiries considerably on a higher side (almost at...

FxWirePro: GBP/CHF gamma puts seem more efficiently sensitive on HY IVs

Jul 14, 2016 10:27 am UTC| Research & Analysis Insights & Views

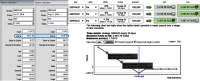

As we can glance over the sensitivity table of this pair, for every shift towards OTM areas we can spot out theincrease in gamma correspondingly and this is not comparatively happening in ITM zones. More importantly, we...

FxWirePro: EUR/JPY put backspreads to optimally bid tepid IVs and bearish-neutral risk reversals

Jul 14, 2016 06:58 am UTC| Research & Analysis Insights & Views

OTC Outlook: The implied volatility of ATM contracts 1w expiries of this the pair has been remarkably reduced, shrinking at around 14.39% and at 13.69% for 1w and 3m tenors respectively (see above nutshell). Although...

Moody's: Australian banks face rising challenges

Jul 14, 2016 03:21 am UTC| Research & Analysis

Moodys Investors Service says that Australian banks are facing a growing number of headwinds due to increasing household leverage and persistently low interest rates, which are increasing the banks sensitivity to...

Jul 13, 2016 13:00 pm UTC| Research & Analysis Insights & Views

Lets have a glance over OTC updates, hedging activities of Swiss franc crosses have been showing less interest in OTC markets. 1w ATM IVs have been lacklustre, slipped below 7% which is on lower side among G10 currency...

Jul 13, 2016 10:13 am UTC| Research & Analysis Insights & Views

We are concerned about the fact that it is generally expected that the BoE would cut its key rate (possibly as early as tomorrow). This rate cut may be sufficiently priced in on the FX hedging market to ensure that it...

- Market Data