Mar 10, 2017 13:09 pm UTC| Central Banks Insights & Views

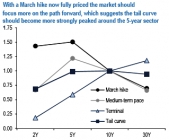

Although the Fed hiking is expected to drive price action, with a March hike now essentially priced in, speculation regarding the near-term pace of tightening is likely to take center stage. Along those lines, our...

FxWirePro: What drives buying cheaper downside Cable volatility and convexity?

Mar 10, 2017 12:39 pm UTC| Research & Analysis Insights & Views

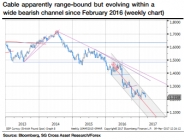

Cable volatility has been extremely directional since 2012, with a strong and stable negative correlation. The Brexit vote in June 2016 initiated a new vol regime (unlike the FX/rates relationship which did not change...

FxWirePro: Red flags for cable and hedging vehicle for risk events

Mar 10, 2017 12:00 pm UTC| Research & Analysis Insights & Views

Cable outlook: Medium-term FX/rates correlation holds again; Fed will hike and MPC wont. Uncertainty is now about the impact of triggering Article 50, not whether or not it happens. 2m vol is undervalued by 2 vols...

ECB keeps policy unchanged, acknowledges improvement in eurozone's economic and inflation situation

Mar 10, 2017 11:59 am UTC| Insights & Views Central Banks Economy

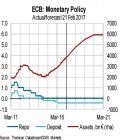

The European Central Bank (ECB) kept interest rates unchanged, including its 2.3 trillion bond-buying program but presented a brighter view of the eurozone economy. ECB president Mario Draghi sounded more upbeat about the...

FxWirePro: Volatility relative to 10y tails assuming next Fed hike odds

Mar 10, 2017 11:48 am UTC| Central Banks Research & Analysis Insights & Views

Although the March meeting ended last week a roughly 1:4 shot for a hike, a range of FOMC members and the Chair herself pushed it to fully priced by this Thursday. With March fully priced, markets should turn to focus...

Mar 10, 2017 09:20 am UTC| Insights & Views

Macro outlook: China: February manufacturing PMI stronger than expected; revising up 1Q GDP forecast. A preview of the NPC meeting. Hong Kong: Trade activity slowed in January. Retail sales continue to...

Mar 10, 2017 07:43 am UTC| Research & Analysis Insights & Views

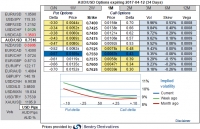

Lets also glance on sensitivity tool for 1-3m IV skews would signify the interests of OTM put strikes that would imply hedging sentiments are for downside risks in the underlying spot FX as Fed is most likely to hike...

- Market Data