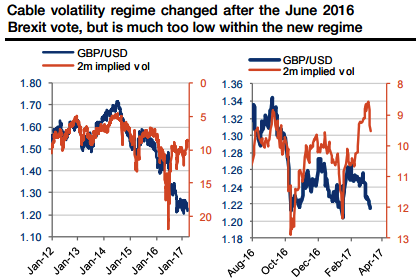

Cable volatility has been extremely directional since 2012, with a strong and stable negative correlation.

The Brexit vote in June 2016 initiated a new vol regime (unlike the FX/rates relationship which did not change throughout the event), as the currency massively depreciated while volatility did not rise in the same proportions (refer above graph).

Maintaining the previous regime would have required vol to stabilize above 15 with cable below 1.30, and realized vol did not support such high vol.

Importantly, such a break did not end vol directionality but instead reset it and shifted the relationship, once the option market had normalized in summer 2016.

Cable vol at 10 corresponded to approximately spot at 1.50 before mid-2016, and since then has been consistent with spot at 1.30.

However, the 2m implied vol has been too low since about one month, according to the prevailing regime (Graph 3b). With the GBP/USD at 1.20-1.22, volatility should be above 12 while most of the ATM curve is currently trading below 10. This is also consistent with the 2m realized volatility which is almost 2 vols above the implied (see above graph), involving a negative volatility risk premium. Implied vol is therefore much too low according to these metrics, in a context where the spot is getting dangerously close to the 1.20 low and macro uncertainty is still extremely elevated. The debate is now about what the long-term impact will be of triggering Article 50, not whether it happens or not. The 2m implied vol is currently undervalued by about 2 vols, and should pick up even more if cable accelerates below 1.20.

Unless an optional strategy involves a calendar spread, its profile will be convex in the region where it is long volatility (gamma and vega being positive together). In reaching the sub 1.20 uncharted territories, the spot is likely to depreciate in a disordered way, with possibly impaired liquidity (one-way market).

With volatility and skew both currently low, the option market would be taken aback and react in bidding vols. As such, we want to obtain downside convexity, which prevents selling low strikes or setting downside barriers. We are also unwilling to take topside unlimited risk (i.e. risk reversal profile).

As a result, we take advantage of the complacent vol and skew and recommend buying a 2m OTM cable put.

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge