Although the March meeting ended last week a roughly 1:4 shot for a hike, a range of FOMC members and the Chair herself pushed it to fully priced by this Thursday.

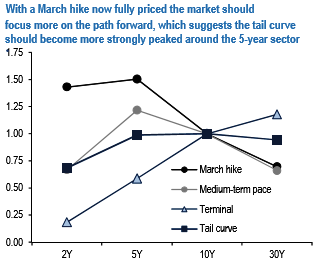

With March fully priced, markets should turn to focus on the path of hikes which argues for taking profits on longs in 3 versus 10-year tails and replacing them with longs in 5-versus 30-year tails.

FF/LIBOR spreads narrowed sharply in the spot and forward space, likely driven primarily by supply technicals and abundant cash in the front end.

Unsurprisingly, the upper left of the implied volatility surface was bid this week as the market rather dramatically re-priced near-term Fed expectations.

The tail curve was notably flatter since we last published, with 3-month volatility on 2-yar tails up 1.4 abp, while 5s were roughly unchanged and 10-and 30-year tails were down 2.1 and 3.5 abp, respectively.

The bottom right of the grid outperformed on light volatility supply, with most long-dated structures in 20-and 30-year tails unchanged to down small as of Friday’s close.

The above chart illustrates the volatility relative to 10-year tails assuming next hike odds, the near-term path of hikes, or terminal Fed funds are the primary drivers* of daily price action relative to the tail curve as of 3/3/17; unitless.

Based on the partial beta of daily changes with respective to 3/15/17x1M OIS rates, Z7/Z8x1M OIS curve slope, and 5Yx5Y OIS rates. Based on a 3-month regression of daily changes in each swap rate versus the same in these factors.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated