FxWirePro: RV trios to celebrate X’mas on unresolved EU-UK trade pact

Dec 19, 2017 10:03 am UTC| Research & Analysis Insights & Views

As 2017 is a year to forget as the macro portfolio suffered and heading towards a fresh year of hope, a trio of relative value trade ideas for the holiday period comes to mine on the eve of Christmas to begin the new year...

FxWirePro: Fundamental driving forces and hedging intricacies of CAD through 2018

Dec 19, 2017 09:11 am UTC| Research & Analysis Insights & Views Central Banks

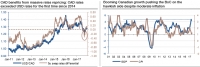

CAD rates recently climbed above USD rates for the first time since 2014 (refer above graph) as the Canadian monetary policy to be more decisive than oil prices, and the USD rates projections can realistically drag the...

Dec 19, 2017 07:30 am UTC| Research & Analysis Central Banks Insights & Views

As the Bank of Japan is lined up for monetary policy announcement tomorrow, which is one of the worlds most dovish central banks, the market consensus in this upcoming event is very meager. Governor Kuroda who has managed...

Dec 18, 2017 15:20 pm UTC| Research & Analysis Insights & Views

The South African rand has been the top performer in the recent past by a large margin as the market grew increasingly confident that Ramaphosa and his allies will win the ANC elective conference election. For all those...

FxWirePro: Scandis still appear rosy against mighty euro – Bid appealing risk reversals

Dec 18, 2017 12:26 pm UTC| Research & Analysis Insights & Views

The krone was hurt after the summer due to strong euro appreciation and a particularly dovish Riksbank communication. However, after testing and rejecting horizontal resistance at 10 in November 2016 and November 2017, the...

Dec 18, 2017 11:59 am UTC| Research & Analysis Insights & Views

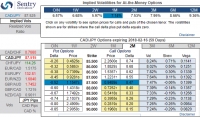

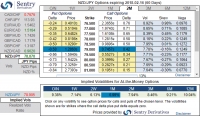

NZDJPY has been oscillating between a range of 83.910 and 75.626 levels since mid-November 2016 and we foresee to continue the same range. Japan posted a JPY 113.4 billion trade surplus in November of 2017, following a...

Dec 18, 2017 08:59 am UTC| Research & Analysis Insights & Views

The EM markets appear subject to local idiosyncratic factors (some common local themes include favorable current account/flow dynamics, FX valuations, and potential central bank tightening) and significant global risks. We...

- Market Data