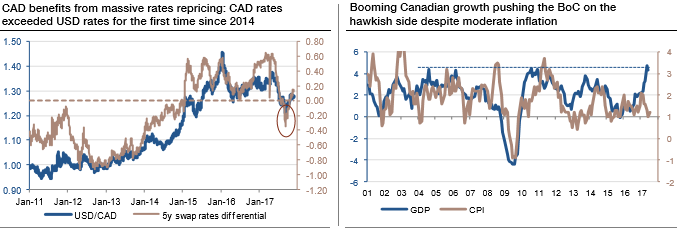

CAD rates recently climbed above USD rates for the first time since 2014 (refer above graph) as the Canadian monetary policy to be more decisive than oil prices, and the USD rates projections can realistically drag the USDCAD to 1.20.

The oil performance has been instrumental in boosting the currency in 2017, even though the long-term picture suggests that the currency has overshot the rebound in oil prices.

However, the CAD is on the right track to remain strong: the interest rates factor is taking over from the commodity factor.

Solid growth to push the BoC on the hawkish side. Market pricing is currently similar for the BoC and the Fed, with the probability of two hikes in 2018 slightly above 30%. Indeed, the CAD has been boosted by the BoC's decision to raise rates to 1% in September, earlier than expected, on the back of a brighter-than-expected economic performance.

In our view, the market consensus is too gloomy on the drag to the Canadian economy from the housing market. While inflation has not yet reached the 2% target, growth indicators (consumer spending, employment) surprised on the upside, suggesting further monetary tightening (refer above graph) as Canadian real GDP is close to 3%.

CAD - cross vols are low and performing. CAD-based implied correlations are priced well below realizeds; owning CADUSD vs CADJPY corres itself or its vol spread proxy in the form of CADJPY – USDJPY vol spreads is a positive carry NAFTA hedge.

CAD-cross vols are also of interest as a potential buy given NAFTA risks in 2018, and CAD correlations that trade at a substantial discount to trailing realized corrs are well priced as carry friendly trade disruption hedges.

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data