Mar 31, 2015 15:43 pm UTC| Commentary

A surprise upgrade to U.K. growth last quarter helped the pound steady after a horrible month in which it has shed six cents against the resurgent greenback. March debuted with sterling at $1.54. But as British inflation...

Mar 31, 2015 15:42 pm UTC| Commentary

Festering worries about Greeces fiscal shape are helping cement the euros worst quarterly performance ever. After shedding 12% in 2014, the most since 2005, euro/dollar was on pace to lose more than 10% in the opening...

Bank of Canada will probably look through the current weakness

Mar 31, 2015 15:15 pm UTC| Commentary

The Canadian economy contracted 0.1% in January. Goods-sectors had a surprisingly solid showing in the month, up 0.3%. Ironically, some of the strength came from mining, oil gas which jumped 1.4%.Services sector activity...

US consumer confidence will continue to improve in the months ahead

Mar 31, 2015 15:03 pm UTC| Commentary

US Conference Boards index of consumer confidence shot up to 101.3 in March from an upwardly revised 98.8 in February (previously reported at 96.4). The reading came in well ahead of the consensus expectation for a flat...

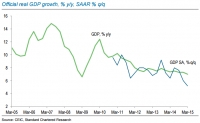

China's softer domestic demand to drag official PMI down in March

Mar 31, 2015 07:24 am UTC| Commentary

The flash estimate for Chinas March HSBC PMI softened to 49.2 from 50.7 in February, the lowest reading in 11 months. Production, new orders and employment all deteriorated, suggesting domestic demand softened over the...

Mar 31, 2015 07:22 am UTC| Commentary

Brazils economic, political and currency travails were popular topics of discussion, with the majority of investors expecting further USD-BRL upside by mid-2015.The Brazilian real (BRL) was viewed as the most vulnerable...

EUR-USD views wide-ranging; Greece not a major focus

Mar 31, 2015 07:21 am UTC| Commentary

Investor views on EUR-USD were among the most wide-ranging of the issues discussed.A small majority expect EUR-USD to end 2015 below current spot, although only a minority expect the pair to trade below parity at some...

- Market Data