The flash estimate for China's March HSBC PMI softened to 49.2 from 50.7 in February, the lowest reading in 11 months. Production, new orders and employment all deteriorated, suggesting domestic demand softened over the reference period.

The official manufacturing PMI is likely to fall from 49.9 in February to 49.7 in March, following the drop in the HSBC survey. This also factors in the scenario that manufacturers might not have fully returned to normal production in March after the late start of the Chinese New Year holidays this year.

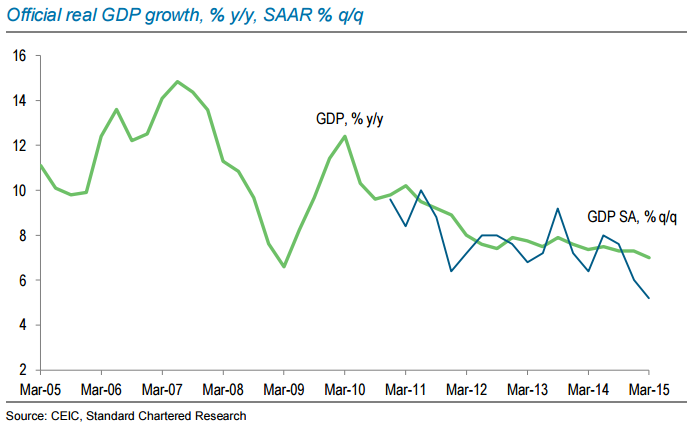

However, it is becoming ever more difficult to sustain the same growth rate as previously given the size of the economy and structural reform headwinds.

"Slowing growth has prompted the need for further monetary easing - and thus we expect two more 50bp RRR cuts and one more 25bp rate cut in the first half of this year", Said Societe Generale in report on Tuesday.

China's softer domestic demand to drag official PMI down in March

Tuesday, March 31, 2015 7:24 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022